Difference Between 'Royalty' & 'Tax' : Supreme Court Explains

LIVELAW NEWS NETWORK

7 Sept 2021 2:50 PM IST

Next Story

7 Sept 2021 2:50 PM IST

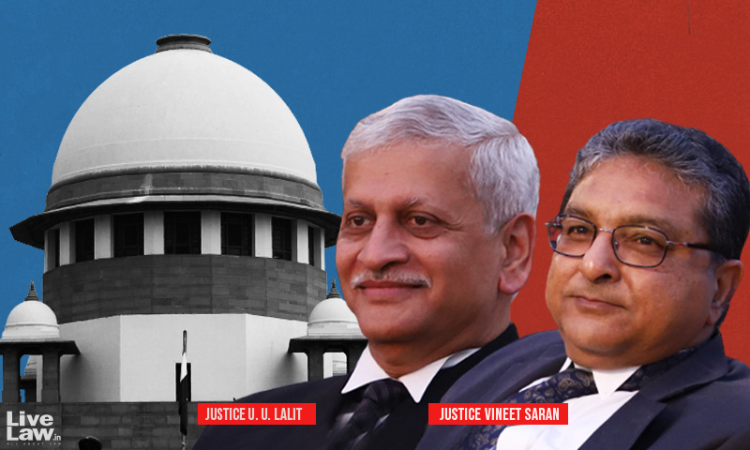

The Supreme Court has explained the differences between the concepts of 'royalty' and 'tax' in a recent decision.A division bench comprising Justices UU Lalit and Vineet Saran observed that 'Royalty' has its basis in an agreement entered into between parties and has a nexus with the benefit or privilege conferred on a grantee. Tax is imposed under a statutory power without reference to...