IBC News

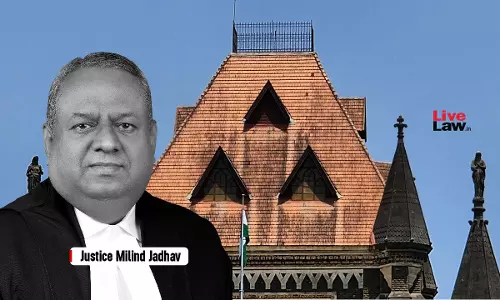

High Courts Cannot Exercise Parallel Contempt Jurisdiction Over NCLT In IBC Cases: Bombay High Court

The Bombay High Court on Monday held that contempt petitions alleging breach of orders passed by the National Company Law Tribunal in insolvency cases cannot be filed directly before the High Court. A single-judge bench of Justice Milind N Jadhav said that once contempt powers are conferred on the NCLT by law, the High Court should not exercise parallel jurisdiction. “Hence, once...

NCLT Kochi Orders Original Concessionaire To Transfer ₹35.83 Lakh Jatayu Project Revenue To Common Pool

The National Company Law Tribunal (NCLT) at Kochi has directed that Rs 35.83 lakh lying in the current account of Guruchandrika Builders and Property Private Limited, the original concessionaire of the Jatayupara Tourism Project, be transferred to the project's common pool account, saying the move was necessary to maintain continuity of financial supervision. The direction was issued in an...

NCLT Delhi Clears Merger Of Fortis Subsidiaries Into Fortis Hospitals Despite SFIO Probe Concerns

The National Company Law Tribunal (NCLT) at New Delhi has approved the merger of four Fortis group subsidiaries into Fortis Hospitals Limited, overruling objections linked to an ongoing investigation into the group's former promoters. The approval was granted on January 5, 2026, nearly two years after the tribunal passed its first order in the matter. The merger will take effect from April...

Settlement Between Operational Creditor and Suspended Director Can't Override Lenders' Claims: NCLT Ahmedabad

The National Company Law Tribunal (NCLT) at Ahmedabad has recently held that a settlement between an operational creditor and a suspended director cannot be used to withdraw a company from insolvency once the Committee of Creditors is in place.Dismissing a withdrawal plea in the insolvency of Vimla Fuels & Metals Limited, the tribunal said such a private arrangement cannot override the...

LiveLawBiz: Business Law Daily Round-Up: January 06, 2026

TAX HSNS Cess Rules Notified: Pan Masala Makers to Pay Levy Based on Installed Machines From Feb 1ITAT Mumbai Sets Aside ₹2.28-Crore Capital Gains Tax on Housing Society For Developer Payments To MembersAmendments To Income Tax Appellate Tribunal Rules Mandate Digital Signatures For Filing AppealsBihar Excise Act | Patna High Court Reduces Penalty From 50% To 30% For Release Of Rental...

Insolvency Proceedings Cannot Be Reopened After Settlement Without Proof Of Fresh Default: NCLT Ahmedabad

The National Company Law Tribunal (NCLT) at Ahmedabad has dismissed an insolvency plea against Shukla Dairy Private Limited, holding that once parties settle and the case is closed, an operational creditor cannot reopen insolvency proceedings without clear bank records showing a fresh default. A coram of Judicial Member Shammi Khan and Technical Member Sanjeev Sharma said bare allegations...

Fraud Has No Look-Back Period, Directors Cannot Use Lapse Of Time As Shield : NCLT Kochi

The National Company Law Tribunal (NCLT) at Kochi has held that allegations of fraudulent and wrongful trading are not restricted by any fixed look-back period, and directors cannot avoid personal liability merely by arguing that the conduct took place long ago. It therefore directed the suspended directors of a Kochi-based insolvent company to jointly contribute Rs 11.95 crore to the...

NCLT Ahmedabad Orders Recovery of ₹2 Lakh Costs From Personal Guarantor As Arrears of Land Revenue

The National Company Law Tribunal (NCLT) at Ahmedabad has directed that costs of Rs 2 lakh imposed earlier on a personal guarantor be recovered as arrears of land revenue, after finding that he had repeatedly ignored its order and failed to pay the amount. A coram of Judicial Member Justice Shammi Khan and Technical Member Sanjeev Sharma noted that the personal guarantor had shown continued...

LiveLawBiz: Business Law Daily Round-Up: January 05, 2026

TAX Mandatory Pre-Deposit For Customs Appeal Cannot Be Waived For Financially Sound Appellant: Karnataka High CourtMere Apprehension of Business Loss In State Does Not Confer Writ Court Territorial Jurisdiction: Calcutta High CourtCustoms Cannot Withhold Part Of Consignment After Accepting Full Bond, Guarantee : CESTAT KolkataHotels Can Now File Specified Premises Opt-In Online On GST...

IBBI Simplifies Liquidation Reporting With Four New Online Forms

The Insolvency and Bankruptcy Board of India (IBBI) has introduced a simplified framework for reporting liquidation updates to the board. To facilitate the same, the Board has introduced four new online forms that track a company's liquidation from start to finish. In a circular issued on Monday (Januray 5) , the Board said the revised system applies from January 1, 2026, and replaces...

Insolvency & Bankruptcy Code: Important Judgments By Supreme Court In 2025

In this article, LiveLaw brings to you a summary of important judgments rendered by the Supreme Court in 2025 in connection with the Insolvency and Bankruptcy Code, 2016. The same are as follows:1. 'IBC A Complete Code' : Supreme Court Disapproves Of High Court Exercising Writ Jurisdiction To Interdict CIRPCase: Mohammed Enterprises (Tanzania) Ltd. v. Farooq Ali Khan & Ors. [Citation:...

NCLT Mumbai Approves Merger Of THPL Warehousing Services Into Booker India

The National Company Law Tribunal at Mumbai has approved the merger of THPL Support Services Ltd into Booker India Ltd, allowing the subsidiary company to be dissolved without winding up as part of a group level corporate restructuring exercise. A coram of Judicial Member Sushil Mahadeorao Kochey and Technical Member Prabhat Kumar in an order dated January 5 observed, “From the...