Telangana High Court

Forced Shift Of Arbitration Venue Without Consent Of Party Amounts To Perversity: Telangana High Court

The Telangana High Court has held that the forced shift of the Arbitration Venue without the consent of a party amounts to perversity and patent lack of inherent jurisdiction.The order was passed in a writ petition, challenging a procedural order, by way of which the venue of the 'Closing hearing' was moved from New Delhi to IDRC in London without considering the objections of...

Telangana High Court Stays Govt Order Granting 42% Reservation To Backward Classes In Upcoming Local Body Elections

The Telangana High Court has stayed the State's decision to grant 42% reservation to Backward Classes (BC) in upcoming local body elections.A division bench of Chief Justice AP Singh and GM Mohiuddin passed the order. Mr. B. Mayur Reddy, Senior Counsel for the petitioner submitted that the impugned G.O.Ms, are violative of two laws:i) The law laid down by the Supreme Court, under Article 142...

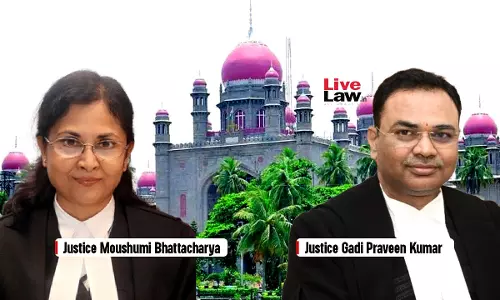

Trade Secret Infringement Requires Existence Of Valid Secret Which Owner Took Reasonable Steps To Protect: Telangana High Court

The Telangana High Court Division Bench, comprising Justice Moushumi Bhattacharya and Justice Gadi Praveen Kumar, observed that while hearing a Commercial Court Appeal (“CCA”), the existence of a trade secret is premised upon an assumption that the information sought to be protected is not readily accessible to others and has an independent economic value. This aspect of a trade...

Circulars/Instructions Of General Superintendence Do Not Require Gazette Notification U/S 69(1) Of Registration Act: Telangana High Court

The Telangana High Court Division Bench, comprising Justice Moushumi Bhattacharya and Justice Gadi Praveen Kumar, observed that while hearing a Civil Miscellaneous Application (“CMA”) observed that the rule-making power of the Inspector General u/s 69(1) of the Registration Act, 1908, does not require any publication in the official gazette. Factual Matrix: The Appellant filed...

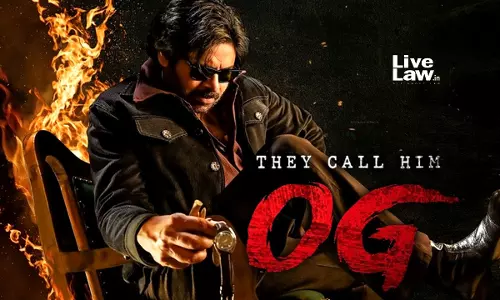

Telangana High Court Extends Interim Order Suspending Govt Memo Permitting Hike On Pawan Kalyan's 'OG' Film Ticket Prices

The Telangana High Court on Friday (September 26) extended its earlier interim order which suspended a memo issued by the state government's home department permitting hike in ticket prices for Pawan Kalyan starrer Telugu movie 'OG'. Justice N.V. Shravan Kumar in his order said,“If the interim order dated 24.09.2025 passed by this Court is modified/vacated with respect to the increase of...

Commercial Courts Act Envisages 'Marked Difference' Between Specified Value & Pecuniary Value: Telangana High Court

The Telangana High Court Division Bench comprising of Justice Moushumi Bhattacharya and Justice Gadi Praveen Kumar while hearing a Civil Revision Petition (“CRP”) observed that specified value forms the foundation of a commercial dispute for admission into the Commercial Courts Act, 2015 (“CC Act”). The pecuniary value, on the other hand, highlights the competence of the Court...

Telangana High Court Suspends Govt Order Hiking Pawan Kalyan's 'OG' Film Ticket Prices

The Telangana High Court in an interim order suspended a memo issued by the state government department permitting cinema theatres to screen one benefit show of actor Pawan Kalyan starrer Telugu movie 'OG' and charge Rs. 800 for it as well as charge other enhanced rates for the movie till October 4. The plea questions an order passed by State's Department of Home permitting exhibition of...

Telangana High Court Suspends Order Setting Aside Group-I Examination Results Issued By Public Service Commission

A division bench of the Telangana High Court, comprising Chief Justice Aparesh Kumar Singh and Justice G.M. Mohiuddin, has suspended the directions in an order passed by the single judge, which set aside the Final Marks List and General Ranking List for Group-I examination conducted by the Public Service Commission.The single judge in his order had noted mass irregularities, bias,...

NEET-PG: Telangana High Court Directs Central Govt Authorities To Consider OCI Card Holder's Plea For Admission Under NRI Quota

The Telangana High Court has directed Central government authorities to consider the application of a medical aspirant possessing an Overseas Citizen of India (OCI) card seeking admission for NEET-PG course claiming eligibility under NRI quota. The order was passed by the division bench of Chief Justice Aparesh Kumar Singh and Justice G.M. Mohidduin in a writ petition filed by a student,...

PIL In Telangana High Court Alleges Rampant Irregularities By Private Schools, Cites Hefty Fees And Non-Implementation Of 25% RTE Quota

A PIL has been filed before the Telangana High Court, stating that the State Government in turning a blind eye to the irregularities conducted by the private schools and non-implementation of Government orders which regulate the functioning of the said schools. The petition filed by retired Professor of Economics A Vinayak Reddy, opposes alleged non-implementation of the...

Telangana High Court Seeks State's Stand On Plea To Regulate Taxi Fares

The Telangana High Court has sought the State government's stand on a plea by Telangana Gig and Platform Workers Union (TGPWU), questioning the State's inaction in regulating taxi fares thereby permitting aggregators to charge 'as per their whims and fancies'.The plea claims that the State's inaction to ensure regulation of fare violates provisions of the Motor Vehicles Act. It claims...

Telangana High Court Grants Anticipatory Bail In Rape Case, Notes History Of Prosecutrix Filing Similar Complaints

The Telangana High Court has granted anticipatory bail to a Doctor, accused of rape, after noting that the complainant had filed similar cases against other individuals on prior occasions.The order was passed by Justice K. Sujana, who noted:“Considering the submissions made by the respective counsel and the material on record,the alleged offence against the petitioner is under Section 64(1)...