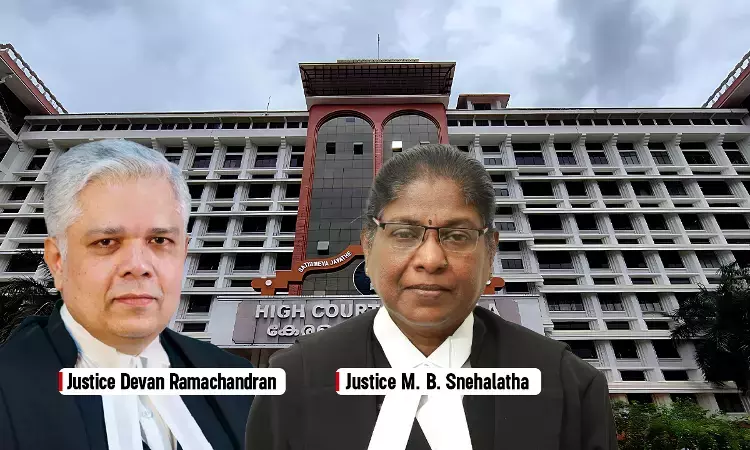

Kerala High Court

Kerala High Court Impleads Anti-Human Trafficking Unit, Social Justice Dept To Trace Out Missing Kuwaiti Resident

The Kerala High Court on Tuesday (November 11) impleaded the Anti-Human Trafficking Unit and the Social Justice Department of the Kerala Government in the habeas corpus plea filed by Santon Lama to trace out his father, Suraj Lama – stated to be missing since October 5 since his arrival in Kochi from Kuwait.The Division Bench comprising Justice Devan Ramachandran and Justice M.B. Snehalatha...

Accused Can Rebut Presumption U/S 139 NI Act By Furnishing Evidence To Dispute Financial Capacity Of Complainant: Kerala High Court

The Kerala High Court recently upheld the trial court's finding of acquittal in an appeal preferred by the complainant in a case under Section 138 of the Negotiable Instruments Act, alleging dishonour of a cheque by the accused.Analysing the precedents laid down, Justice Johnson John observed that when the defence evidence to dispute the transaction as well as the financial capacity of...

Kerala High Court Stays Electricity Regulatory Commission's 2025 Renewable Energy Regulations

The Kerala High Court on Monday (November 10) stayed the operation, implementation/ enforcement and all further proceedings under the Kerala State Electricity Regulatory Commission (Renewable Energy and Related Matters) Regulations, 2025 issued by the Regulatory Commission vide a notification on November 5.Justice Mohammed Nias C.P. passed the interim order on a plea by Domestic On-Grid...

Mentioning Contraband's Quantity In Millilitres Instead Of Grams Doesn't Vitiate NDPS Case If Chemical Report Shows Equivalent Weight: Kerala HC

The Kerala High Court has held that specifying the quantity of the contraband seized under NDPS Act, 1985 in millilitres instead of grams does not vitiate the prosecution, provided the chemical analysis report establishes the equivalent strength in weight as prescribed under the law.Justice Bechu Kurian Thomas, made the observation while delivering judgment in a criminal appeal against...

'Melpattam' Right Confers Only Usufructuary Interest, Not Ownership Over Land: Kerala High Court Reiterates

The Kerala High Court has reaffirmed that a 'melpattam' arrangement does not create ownership or a transferable interest in the land itself.The division bench comprising Justice Sathish Ninan and Justice P Krishna Kumar, delivered the judgment while dismissing an appeal challenging a preliminary decree for partition passed by the Sub Court, Vadakara. The appellant claimed exclusive ownership...

Father's Retirement Benefits Can Be Attached For Child's Maintenance, S.60(1)(g) CPC Exemption Won't Apply: Kerala High Court

The Kerala High Court has recently held that a court can attach a father's retirement benefits for maintaining his child. It further clarified that the exemption under Section 60(1)(g) of the Code of Civil Procedure, which provides that stipends and gratuities of pensioners are not liable to attachment and sale in execution of a decree, would not apply in such cases.Distinguishing the...

Kerala High Court Mourns Demise Of Former Judge Justice K. John Mathew

The Kerala High Court on Monday (November 10) mourned the passing of Justice K. John Mathew (93), who had served as judge of the High Court from 1984 to 1994.After retirement, Justice Mathew was designated Senior Advocate by the Supreme Court and he continued his practice in New Delhi till 2003. He was head of the Government Commission setup to study the effects of Mineral Sand Mining along...

Complainant/ Legal Heirs Must Be Informed When Probe Against Accused Named In FIR Is Dropped: Kerala High Court

The Kerala High Court has directed the State Police Chief to issue necessary instructions to investigating authorities in criminal cases to issue notices to the de facto complainants or their legal heirs when a person named as an accused in the FIR is removed from the list of accused during the course of investigation.The division bench comprising Dr. Justice A K Jayasankaran Nambiar and...

State Financial Enterprise Transferring Funds From Borrower's Frozen Bank Account Without Authority Violates Article 300A: Kerala High Court

The Kerala High Court has restrained the Kerala State Financial Enterprises (KSFE) and its Recovery Officers from transferring amounts from a borrower's frozen bank account to third party accounts, holding that such a move would violate the constitutional protection against deprivation of property without authority of law under Article 300A of the Constitution of India.Justice V.G. Arun...

Kerala High Court Weekly Round-Up: November 03 To November 09, 2025

Nominal Index [Citations: 2025 LiveLaw (Ker) 701 - 719]Madathil Pakruti v. T.P. Kunjanandan and Anr., 2025 LiveLaw (Ker) 701Angels Nair v. Union of India and Ors., 2025 LiveLaw (Ker) 702Shahabeen Hameed v. Muhammed Ajnas A.B., 2025 LiveLaw (Ker) 703Sivadasan Nair K.G. v. State of Kerala, 2025 LiveLaw (Ker) 704Treasa K.J. v. State of Kerala, 2025 LiveLaw (Ker) 705S. Jayasree. v. State of...

Disclosure Of Income & Payment Of Income Tax Do Not Bar Proceedings Under Benami Transactions Act: Kerala High Court

The Kerala High Court has held that disclosure of income and payment of tax under the Income Tax Act, 1961, does not preclude initiation of proceedings under the Prohibition of Benami Property Transactions Act, 1988. Justice Ziyad Rahman A.A. agreed with the department that the fact that the assessees have disclosed the income in the return and the same was proceeded against under...

Kerala High Court Acquits Man Over Possession Of Fake Dollar Bill, Says No Conscious Possession Or Intent To Use

The Kerala High Court recently acquitted a person, who was found guilty of the offence under Section 489C of the Indian Penal Code [Possession of forged or counterfeit currency-notes or bank-notes], for possessing a counterfeit 100 Dollar bill.Justice Johnson John relied on the 2005 decision of the Supreme Court in K. Hasim v. State of T.N. to find that the offence under the provision is...