Kerala High Court

Man Starting New Marriage For 'Greener Pasture' Won't Turn Prior Consensual Relationship Into 'Rape': Kerala High Court

The Kerala High Court, in a recent judgment, held that if a man starts a new marriage in search of 'greener pasture', the same by itself, would not turn his prior, consensual sexual relationships into 'rape' as per the Indian Penal Code.Justice G. Girish clarified that in such cases, consent for earlier sexual relationships cannot be said to have been obtained on false promise to...

Contractor Can Claim Increased GST During Work, Even If Bills Were Paid Before Rates Increased: Kerala High Court

The Kerala High Court has held that a contractor can claim increased GST (Goods and Services Tax) during work, even if bills were paid before the rate increase. Justice Ziyad Rahman A.A. opined that at the time of execution of the contract, the rate was only 5% and the increase took place during the execution of the work. Thus, the assessee is entitled to a differential amount of tax....

CSR Funds Scam: Kerala High Court Allows Consolidated Bail Bonds For Accused Facing Over 1300 Cases

The Kerala High Court recently (November 13) allowed an accused, facing over 1,300 criminal cases across the State in the Corporate Social Responsibility (CSR) Scam, to secure his release on bail by executing single district-wise surety bonds, instead of separate bonds in each case.Justice Bechu Kurian Thomas delivered the judgment while allowing the petition filed by K N Anadakumar, who...

'Govt Moving With Corrupt Persons': Kerala High Court Remarks As State Again Declines Sanction For CBI To Prosecute Ex-Officials Of Cashew Corp

Third time after the Kerala government refused sanction for CBI to prosecute allegedly corrupt ex-officials of the State Cashew Development Corporation (KSCDC), the High Court orally slammed the government for "protecting" corrupt persons.“Government is moving with the corrupt persons…I am inclined to write this in another judgment. This is very very contemptuous attitude. Why the...

Kerala High Court Directs GST Department To Ensure No Tax Evasion In Frozen Chicken Sale

Disposing of a writ petition alleging that frozen chicken was being sold at 0% GST instead of the applicable 5%, the Kerala High Court recently directed the GST department to ensure that no tax evasion takes place. Justice Ziyad Rahman A.A. also noted that the State GST Department was already investigating the matter. Hence, the Court disposed of the writ petition filed by the...

'Democracy Should Win': Kerala High Court Asks Election Commission To Reconsider Deletion Of Youth Congress Candidate's Name From Voter List

The Kerala High Court on Monday (November 17) directed the State Election Commission to decide by Wednesday (November 19) the plea of Vyshna S.L., the 24-year-old Congress candidate of Muttada Division of Trivandrum Corporation, regarding deletion of her name from the voters list.According to the plea, the petitioner is an IT professional who was identified by the Indian National Congress...

Kerala High Court Rejects Plea To Temporarily Shift Courtroom To Ground Floor For Diabetic Advocate, Permits Cross-Examination Via VC

In a recent judgment, the Kerala High Court rejected a plea to temporarily shift courtroom from the 1st floor to the ground in order accommodate a diabetic advocate, who cannot climb stairs, to conduct cross-examination in trial.Justice C.S. Dias opined that courts must be sympathetic to the difficulties faced by advocates and practical alternatives can be devised so as not to disrupt...

Kerala High Court Clears Acquisition Of Tea Estate Land For Wayanad Victims' Rehabilitation; Says Compensation To Be Settled Between Companies

The Kerala High Court has recently disposed of a writ appeal and three connected writ petitions filed by M/s Elstone Tea Estates Ltd. and M/s Padhoor Plantations Pvt. Ltd., related to the acquisition of land for the rehabilitation of 2024 Wayanad Landslide victims under the Disaster Management Act.For context, after the landslide on July 30, 2024 in the Chooralmala, Mundakkai and...

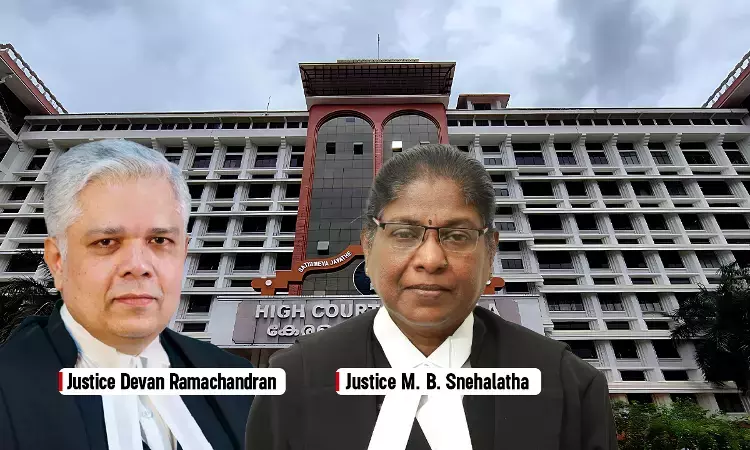

Kerala High Court Raps State Over Lax Response To Periyar River Pollution, Says It May Have 'Catastrophic Consequences'

The Kerala High Court has expressed deep frustration at the "continued inaction" of both the Kerala and Central government in addressing the pollution of the Periyar river.The Division Bench comprising Justice Devan Ramachandran and Justice M B Snehalatha noted that nearly two weeks have passed since its previous directive calling for expedited steps to set up an Effluent Treatment Plant...

Income Tax Act | Co-operative Societies Not Engaged In Banking Not Entitled To TDS Exemption U/S 194A(3)(iii): Kerala High Court

The Kerala High Court has held that co-operative societies not engaged in banking are not entitled to TDS (Tax Deducted at Source) exemption under section 194A (3)(iii) of the Income Tax Act. Section 194A(3) of the Income Tax Act, 1961 provides exemptions from TDS on interest for certain persons or institutions. Justice Ziyad Rahman A.A. was dealing with a petition...

'Mode Of Access To Temple Not Essential Religious Practice': Kerala High Court Declines Early Opening Of Traditional Forest Route To Sabarimala

The Kerala High Court recently refused to allow a lawyer's plea for opening the traditional forest route (Kanana Patha) to Sabarimala ahead of the date announced by the authorities.The Division Bench comprising Justice Raja Vijayaraghavan V. and Justice K.V. Jayakumar observed that the deferment of opening of the Kanana Patha does not infringe upon the petitioner's fundamental right.Further,...

Kerala High Court Weekly Round-Up: November 10 - November 16, 2025

Nominal Index [Citations: 2025 LiveLaw (Ker) 720 - 741]Shareena v State of Kerala and Ors., 2025 LiveLaw (Ker) 720Vittal Sait Popat v. The Assistant Commissioner of Income Tax, 2025 LiveLaw (Ker) 721Venugopal K Veloth v Mahilamani and Ors., 2025 LiveLaw (Ker) 722Thangam v. V.V. Haridasan and Anr., 2025 LiveLaw (Ker) 723Rifa Fathima v. Salim and Ors., 2025 LiveLaw (Ker) 724Sigmatic Nidhi Ltd....