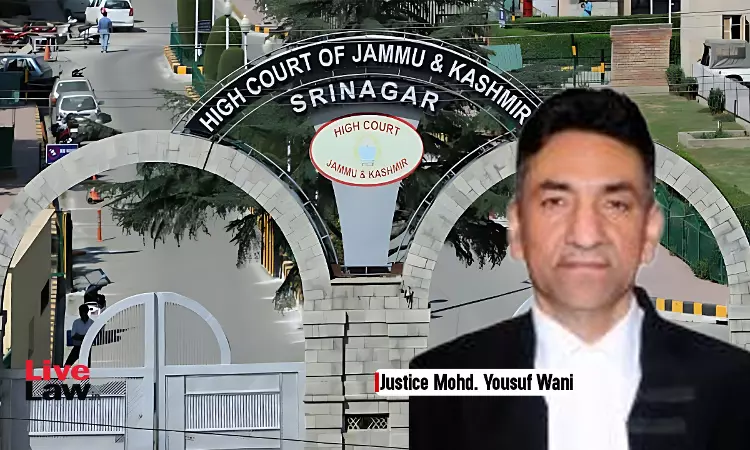

Criticising the growing trend of directly approaching the High Court for bail under Section 483 of the Bharatiya Nagarik Suraksha Sanhita (BNSS), 2023 the Jammu and Kashmir and Ladakh High Court has observed that bypassing the trial courts in such matters not only burdens the High Court but also disregards the legal protocol, where such petitions should typically be first addressed by the...