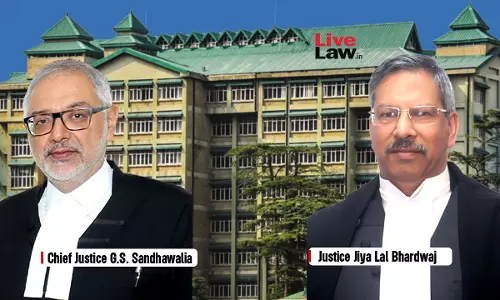

Himachal Pradesh High Court

Punjab Excise Act | Half-Filled, Unsealed Liquor Bottles Cast Serious Doubt: Himachal Pradesh High Court Upholds Acquittal

The Himachal Pradesh High Court dismissed the State's appeal, which challenged the acquittal of an accused for the commission of an offence punishable under Section 61(1)(a) of the Punjab Excise Act (unlawfully possess any intoxicant (like liquor or drugs) or materials/apparatus for making them).The Court held that serious lapses in sealing, production, and identification of the seized...

State Employees' Absorption Policy Must Be Applied Uniformly; Denial After Eligibility Is Arbitrary: Himachal Pradesh High Court

The Himachal Pradesh High Court allowed held that once the petitioner acquires the requisite qualification and the policy continued to operate, absorbtion cannot be denied.Justice Sandeep Sharma remarked that:“Once it is not in dispute that communication dated 06.03.2017 has not been withdrawn till date and pursuant to afore communication, number of similarly situate persons have been...

Social Media Chats Criticising War, Calling for Communal Harmony Do Not Constitute Sedition: Himachal Pradesh High Court

The Himachal Pradesh High Court has granted regular bail to a petitioner accused under Section 152 of the Bharatiya Nyaya Sanhita, 2023, which corresponds to the offence of sedition under Section 124A of the Indian Penal Code. The Court held that mere criticism of war, expression of dissent, or advocacy of peace on social media, without incitement to violence or public disorder, does not...

MSME Facilitation Council Cannot Assume Civil Court Powers; Reference Cannot Be Rejected On Limitation At Conciliation Stage: HP High Court

The Himachal Pradesh High Court held that a Micro and Small Enterprises Facilitation Council functions within the statutory framework of the MSMED Act, 2006 and cannot equate itself with a civil court. The Court further clarified that the Facilitation Council has no authority to invoke or exercise powers vested in civil courts under Section 9 of the Code of Civil Procedure.Justice Ajay Mohan...

Family Court Retains Jurisdiction To Decide Property & 'Stridhan' Claims Even After Divorce Decree: HP High Court

The Himachal Pradesh High Court held that a Family Court does not lose jurisdiction to decide disputes relating to stridhan, gifts, and other matrimonial property merely because a decree of divorce has already been passed. Setting aside the Family Court's dismissal of the wife's application under Section 27 of the Hindu Marriage Act, the High Court remarked that property disputes between...

Driver Must Slow Down When Pedestrians & Cattle Are On Road; Failure Amounts To Negligence: Himachal Pradesh High Court

The Himachal Pradesh High Court has upheld the conviction of an accused in a fatal road accident case, holding that when pedestrians and cattle are moving on the road, the driver is required to slow down and drive with caution; failure to do so constitutes negligence.The Court further remarked that the accused failed to reduce speed despite cattle movement on the road and drove the vehicle in...

Income Tax Act | HP High Court Stays Reassessment Proceedings U/S 148 As Validity Of Notices Were Pending Before SC

The Himachal Pradesh High Court has stayed reassessment proceedings initiated against an assessee under Section 148 of the Income Tax Act, 1961, noting that the validity of such notices is already under consideration before the Supreme Court. A Division Bench comprising Justice Vivek Singh Thakur and Justice Romesh Verma passed the order while hearing a writ petition which had...

Entry-Tax Interest & Penalty From Employer's Delay Cannot Be Shifted To Contractor In Arbitration: HP High Court

The Himachal Pradesh High Court has recently clarified that statutory interest and penalty arising from delayed payment of entry tax cannot be shifted onto a contractor when the delay was caused by the employer's own failure to act in time, and where the arbitral tribunal had consciously restricted the contractor's scope of liability. Justice Ajay Mohan Goel in an order dated...

HP High Court Questions Shifting Of RERA Office From Shimla To Dharamshala; Interim Order Restraining Shift To Continue

The Himachal Pradesh High Court admitted a petition challenging the decision of the State Government to shift the Real Estate Regulatory Authority office from Shimla to Dharamshala.The Court remarked that RERA was a small institution with limited manpower and that the State ought to consider relocating larger offices instead of burdening a statutory authority with minimal staff.A Division...

State Cannot Deny Work-Charged Benefits To Eligible Worker On Ground Of Cadre Abolition: HP High Court

The Himachal Pradesh High Court held that abolition of the work-charged establishment in 2005 could not nullify a right that had already accrued in favour of the employee in 2003. Justice Ranjan Sharma remarked that: “Once a right for work charge status had accrued to the petitioner on completion of 8 years of continuous service w.e.f. 01.01.2003… the abolition of work charge establishment...

Employee Who Forgoes Earlier Promotion Can't Claim Reconsideration Within One Year: HP High Court

The Himachal Pradesh High Court dismissed a writ petition filed by Indu Sharma, a retired Junior Assistant, challenging the placement and promotion of her juniors to the post of Senior Assistant in the Department of Language and Culture.Justice Ranjan Sharma remarked that: “If an employee was promoted to a higher post and such an employee refuse or foregoes his promotion then, the said...

Negligence Not Bona Fide: Himachal Pradesh High Court Rejects Plea To Extend Time For Depositing Deficient Court Fee

The Himachal Pradesh High Court dismissed a petition filed by Satish Kumar, refusing to interfere with the Trial Court's order which denied extension of time for depositing deficient court fee in a decree for specific performance. The Court held that the petitioner failed to establish bona fide reasons or absence of negligence and therefore did not deserve discretionary relief under Article...