Gujarat High Court

'Police Didn't Register FIR': Father Tells Gujarat High Court In Plea For Independent Probe Into Minor Daughter's Alleged Rape

The father of a minor girl from Rajasthan who claimed that his daughter was raped, told the Gujarat High Court on Wednesday (December 10) that the police failed to register the FIR even when a cognizable offence was made out which was in complete violation of mandate in Lalita Kumari judgment. He further said that the delay in the case was caused because police remained inactive. On Monday...

CST Act | After 20 Yrs, Gujarat High Court Permits PSU To Claim Branch Transfer Exemption Denied For Non-Production Of Original 'Form-F'

After almost 20 year litigation, the Gujarat High Court permitted a public sector energy enterprise to claim branch transfer exemption of over Rs 6 crore under the Central Sales Tax Act, which was denied earlier on non-production of the original Form-F. Form F is a document used for branch transfer of goods in the course of inter-state trade, which permits claiming of exemption from Central...

Supplying AI-Powered IT Infra Services, Content To USA Corp By Indian Counterpart Is 'Export' Not 'Intermediary' : Gujarat High Court

The Gujarat High Court has held that rendering software consultancy services including editorial and content creation activities as well as customer support services to Infodesk Inc., Parent Company in the United States is 'export of service' and not 'intermediary service'. In a judgment dated November 27, 2025 the Bench comprising Justice A.S. Supehia and Justice Pranav...

Gujarat High Court Directs No Coercive Action Against Man Challenging Vacation Notice On Property Allotted To Him After 2001 Earthquake

The Gujarat High Court on Tuesday (December 9) directed the state authorities to grant personal hearing to a man who had challenged a notice asking him to vacate a property, given to him on lease after 2001 earthquake, used by him to run an electronic repair shop. In doing so the court also restrained the authorities from taking any coercive action until a decision is taken by them in the...

Gujarat High Court Issues Notice On Father's Plea For Independent Probe Into Alleged Rape, Death Of 17-Yr-Old Daughter

The Gujarat High Court on Monday (December 8) issued notice on a Rajasthan resident's plea seeking an independent probe into the alleged rape and death of his 17-year-old daughter who had moved to the State to work as a labourer. Justice MR Mengdey issued notice to the State and said, "Issue notice to respondent 1 and 4 returnable on 10-12-2025. In the interregnum the investigation is handed...

Gujarat High Court Directs State Authorities To Take Measures To Stop 'Illegal Mining' Activities In District Amreli

The Gujarat High Court on Monday (December 8) directed the State authorities to take steps to stop any "illegal mining" claimed to be carried out by private entities in district Amreli, while hearing a plea claiming that mining activities were being carried out despite rejection of environment clearance. Issuing notice on the petition a division bench of Chief Justice Sunita Agarwal and...

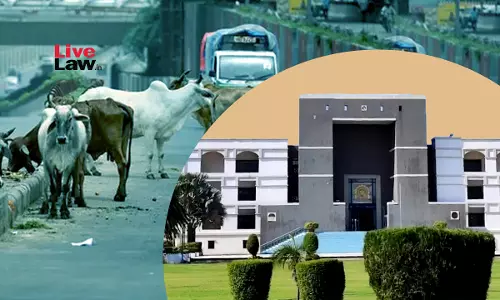

Gujarat High Court Asks Dwarka Municipality To Inform On Steps Taken To Curb Menace Of Stray Bulls

The Gujarat High Court on Monday (December 8) asked Dwarka Municipality to inform on steps taken to curb menace of stray cattle/bulls in the area while hearing a PIL which claimed that several lives have been lost after being hit by such stray cattle. A division bench of Chief Justice Sunita Agarwal and Justice DN Ray asked the Chief Officer of Dwarka Nagarpalika to file an affidavit "to...

'Era Of Social Media': Gujarat High Court Asks State To Publicize Prohibitory Orders Under S.144 CrPC Online

The Gujarat High Court has directed the state authorities to widely publicize prohibitory orders under Section 163 BNSS (earlier Section 144 CrPC)–prohibiting assembly of four or more persons in a specific area to prevent urgent nuisance or on apprehending danger–on "social media" to generate public awareness about the same. In doing so the court observed that mere publication of such...

'Used Excessive Speed': Gujarat High Court Declines To Discharge Accused In Iskcon Bridge 'Hit & Run' Case

The Gujarat High Court refused to discharge Tathya Patel for culpable homicide not amounting to murder (IPC Section 304 part 2) accused in the 2023 Iskcon Bridge hit and run case which claimed nine lives in Ahmedabad, observing that there was a strong prima facie case against him. The court said that this was not a simple case of rash and negligent driving, wherein the applicant was under...

Gujarat High Court Allows Pfizer's Additional Claims Worth ₹15 Crore Under Central Sales Tax Act, Sets Aside VAT Tribunal Order

The Gujarat High Court has allowed writ petition by Pfizer, a pharmaceutical major against the Value Added Tax (VAT) Tribunal order that expressly barred the consideration of any additional Form-F. In a judgment dated November 20, 2025, the Division Bench comprising Justice A.S. Supehia and Justice Pranav Trivedi noted the 11-year pendency in litigation in relation to production of...

S. 148 Income Tax Act | Reassessment Based On Mere Change Of Opinion Without Concrete Evidence Not Justified: Gujarat High Court

The Gujarat High Court has reiterated that reopening of income tax assessment under Section 148 of Income Tax Act based on mere change of opinion without concrete material is not justified, when the return has been threadbare examined during initial assessment and approved without failure of disclosure.It noted that as per the AO's own findings he was unsure about the actual escaped income...

Gujarat High Court Quashes GST Orders For Failure To Intimate Personal Hearing; Says Assessee Must Be Notified Before Final Order

The Gujarat High Court on Wednesday (December 3) quashed order issued to entity for failing to intimate about personal hearing, which had claimed that after notice of GST DRC-01 was issued to it, the authority did not intimate the date and time of personal hearing which was against principles of natural justice. In doing so the court said while issuing DRC-01 it would not be mandatory...