Gauhati High Court

High Court Closes PIL Against 'Illegal' Stay Of Migrants & 'Insignificant Deportations' As Per Assam Accord, Awaits SC Verdict

The Gauhati High Court on Wednesday closed a Public Interest Litigation (PIL) plea that sought the strict implementation of the deportation clauses of the Assam Accord, 1985, in view of the pendency of similar substantial issues before the Supreme Court. A Bench of Justice Michael Zothankhuma and Justice N. Unni Krishnan Nair, disposed of the petition filed by the Assam Andolon...

Arbitration Clause In GeM Contract Becomes Inoperative Once S.18 Of MSMED Act Is Invoked Before MSME Council: Gauhati High Court

The Gauhati High Court has held that once a supplier invokes Section 18 of the Micro, Small and Medium Enterprises Development Act, 2006 (MSMED Act), the statutory dispute-resolution mechanism under the Act overrides the arbitration clause contained in a Government e-Marketplace (GeM) contract, including the agreed seat of arbitration.The ruling was delivered by Justice Manish Choudhury,...

2018 Tezu Police Station Lynching Case | Gauhati High Court Sets Aside Discharge Of Accused, Directs Framing Of Murder Charges

While allowing a criminal petition filed by the State challenging the trial court's order discharging six respondents accused of dragging two rape-and-murder suspects out of the Tezu Police Station in Arunachal Pradesh in 2018 and lynching them in public, the Gauhati High Court has held that the material collected during investigation created grave suspicion against the accused and...

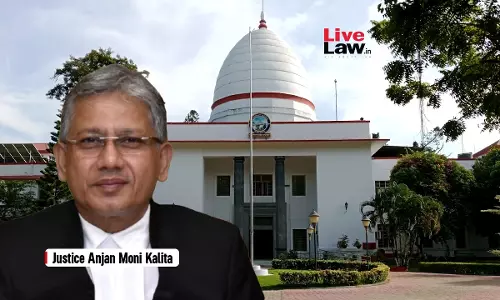

Once Land Passbook Is Issued, Allottee Retains Right And Title Until Cancellation: Gauhati High Court

The Gauhati High Court has held that once government-allotted land is transferred and the transfer is approved through issuance of a Land Pass-Book, the allottee continues to hold right and title over the land until the allotment is cancelled or withdrawn by the competent authority.Justice Anjan Moni Kalita, presiding over the case, observed, “this is not agreeable that the Land Pass-Book...

Real-Time Case Status, WhatsApp Updates Channel: Gauhati High Court Kohima Bench Launches Mobile App To Make Court Services Accessible

The Gauhati High Court, Kohima Bench, has launched its official mobile application, the GHCKB App, to help make court information easier, faster, and more accessible for the public.The app was launched on Wednesday by Chief Justice Ashutosh Kumar at the Multi-Purpose Hall, Bar Room, Kohima, in the presence of Justice Sanjay Kumar Medhi and Justice Arun Dev Choudhury.While delivering his...

Executive Can't Enforce DV Order: Gauhati High Court Quashes Annulment Of Husband's Land Possession Certificate

The Gauhati High Court quashed an order passed by appellate authority under Arunachal Pradesh government's land management department which had cancelled a land possession certificate issued to a husband, based on alleged violation of interim order by the trial court in favour of his estranged wife under domestic violence act. In doing so the court observed that the appellate authority lacked...

No Sexual Overtone: Gauhati High Court Quashes S.354 IPC Charge Against MLA Jignesh Mevani Accused Of Outraging Woman Cop's Modesty

The Gauhati High Court has discharged Gujarat MLA Jignesh Mevani from the charge of outraging the modesty of a woman police officer, holding that the materials collected during investigation did not reveal any act carrying a sexual overtone capable of attracting Section 354 IPC. The court however retained the charged against Mevani under IPC Section 352 (Punishment for assault or criminal...

Contingency Driver Not Entitled To Seek Regularisation Or Promotion Against Direct Recruitment: Gauhati High Court

The Gauhati High Court has held that a contingency driver cannot claim either regularisation or promotion into a vacancy that is earmarked for direct recruitment under the applicable Recruitment Rules and the post-based roster. Presiding over the case, Justice Manish Choudhury, observed, “Though a right to be considered for promotion is a fundamental right but such right to be considered...

Executive Need Not Wait For Rules When Act Lays Procedure: Gauhati High Court Upholds Itanagar Mayor Reservation For Scheduled Tribe Women

While dismissing a PIL filed against the reservation of the Itanagar Mayor's post for APST (Arunachal Pradesh Scheduled Tribes) women, the Gauhati High Court has held that the Deputy Commissioner's decision to reserve the post by draw of lots was valid under the proviso to Section 53(1) of the Arunachal Pradesh Municipal Corporation Act, 2019.A Division Bench comprising Justice Kalyan Rai...

Customary Court Can't Enlarge Strength Of Bench After Hearing Ends Or Back Date Its Orders: Gauhati High Court

The Gauhati High Court has held that an Inter-Village Territorial Customary Court cannot enlarge its forum after the conclusion of hearing or retrospectively date a later decision without granting a fresh hearing.Justice Budi Habung presiding over the case, observed, “Such enlargement of the forum after conclusion of hearing and retrospective dating of a later decision without further...

Female Transgenders Can't Be Put Through Rigours For Male Candidates: Gauhati High Court Suggests To State For Reservation Policy

Dealing with a PIL challenging an allegedly discriminatory police recruitment advertisement where seats allocated to transgender persons were clubbed with male candidates, the Gauhati High Court has suggested that female transgenders cannot be put through the same rigours as the male candidates.The impugned advertisement was published by the Police Department for recruitment of...

Arrested At 1AM In Violation Of CrPC Safeguards, Gauhati High Court Grants Bail To Woman After 2.5 Years In Custody

The Gauhati High Court recently granted bail to a woman doctor, booked for ill-treating her foster child, after finding that she had been arrested at night without prior permission of the Judicial Magistrate of the first class, in violation of the mandatory safeguards prescribed under the Code of Criminal Procedure.Dr. Sangeeta Dutta was arrested in 2023 along with her husband Dr. Walliul...