Entertainment Tax Act Does Not Contain Mechanism To Assess Or Collect Tax On Sponsorships: Delhi High Court

Nupur Thapliyal

7 Aug 2024 5:45 PM IST

Next Story

7 Aug 2024 5:45 PM IST

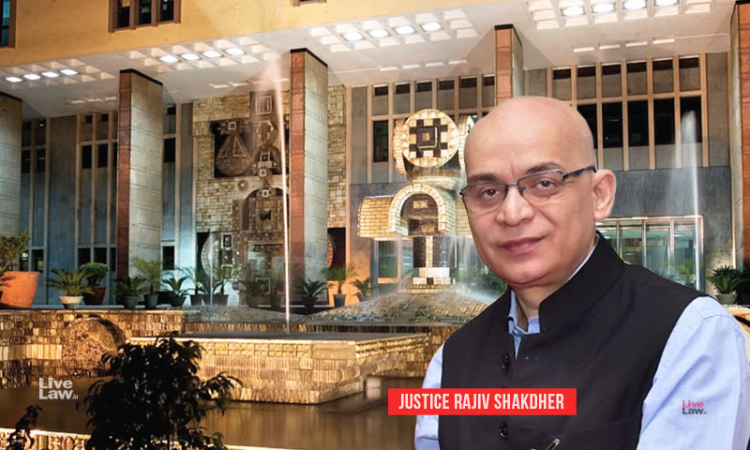

The Delhi High Court has observed that the Entertainment Tax Act does not contain a mechanism for assessing and collecting tax on sponsorships.Justice Rajiv Shakdher observed that imposition of a tax on sponsorship under the Entertainment Tax Act must fail in the absence of a specific charging provision.“The unamended Section 2(m) of the Entertainment Tax Act did not cover sponsorship...