Delhi High Court

Delhi High Court Declares Tibetan-Origin Woman Born In Dharamshala As Indian Citizen, Directs Issuance Of Passport

The Delhi High Court has declared a Tibetan-origin woman born in Dharamshala in 1966 as an Indian citizen by birth under Section 3(1)(a) of the Citizenship Act, 1955, and directed that she be issued an Indian passport.Justice Sachin Datta allowed the plea filed by one Yangchen Drakmargyapon seeking recognition of her Indian citizenship and a direction for issuance of an Indian...

Delhi High Court Upholds Centre's Decision Recognising Indian Pickleball Association As National Sports Federation

The Delhi High Court has dismissed a petition filed by the All India Pickleball Association (AIPA) challenging the Union Government's decision to recognise the Indian Pickleball Association (IPA) as the National Sports Federation (NSF) for the sport in the country.Justice Sachin Datta held that it cannot be said that grant of recognition to IPA was ex-facie arbitrary or suffered from...

Citing Franz Kafka, Delhi High Court Orders Premature Release Of Former President's Bodyguard; Slams SRB's 'Mechanical' Denials

Citing writer Franz Kafka, the Delhi High Court has ordered premature release of a former President's Bodyguard, who is serving life sentence for the 2003 robbery and gang rape of a young woman.Justice Neena Bansal Krishna held that the authorities, including the Sentence Review Board (SRB) acted arbitrarily in repeatedly denying him premature release despite over two decades of...

Cumulative PG Residency Across Institutions Valid If Prospectus Is Silent: Delhi High Court Quashes AIIMS' Rejection Of Top Rank Holder

The Delhi High Court has quashed a decision of the All India Institute of Medical Sciences (AIIMS) cancelling the candidature of a top-rank holder for admission to the DM (Critical Care Medicine) course, holding that postgraduate residency of 1,095 days can be cumulative across institutions when the prospectus does not mandate training from a single institute.Justice Jasmeet Singh held that...

Abscondence Of Co-Accused Can Be A Relevant Factor While Deciding Bail Under NDPS Act: Delhi High Court

The Delhi High Court has held that the presence of an absconding co-accused can be a relevant factor while considering bail under Section 37 of the Narcotic Drugs and Psychotropic Substances (NDPS) Act.Justice Saurabh Banerjee was hearing the bail application filed by a foreign national accused in a case involving recovery of 256 grams heroin— commercial quantity of narcotic substance,...

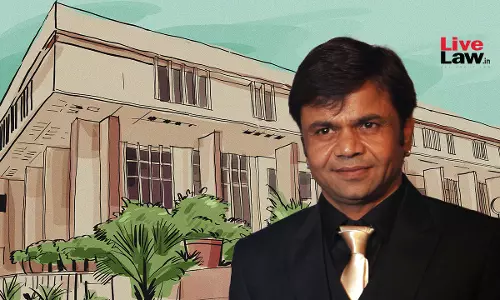

Cheque Bounce Case: Delhi High Court Orders Bollywood Actor Rajpal Yadav To Surrender, Raps Repeated Breach Of Settlement Undertakings

The Delhi High Court yesterday directed Bollywood actor Rajpal Naurang Yadav to surrender before the concerned Jail Superintendent by February 04, after coming down heavily on him for repeatedly breaching undertakings given to the Court regarding payment of settlement amounts in cheque dishonour cases.Justice Swarana Kanta Sharma observed that the conduct of the actor “deserves to...

Delhi High Court Refuses To Reopen IFS Cadre Allocation Despite Admitted Error, Cites Delay And Cascading Impact

The Delhi High Court has refused to reopen the Indian Forest Service (IFS) cadre allocation of an officer, holding that even an admitted error in vacancy calculation cannot justify unsettling cadre allocations after a long lapse of time, given the serious cascading consequences such a move would entail.A Division bench of Justices Anil Kshetarpal and Amit Mahajan were hearing a writ...

Delhi High Court Allows Sameer Wankhede To Approach Mumbai Court To File Defamation Suit Against 'Ba***ds of Bollywood'

The Delhi High Court on Tuesday allowed IRS officer Sameer Wankhede to approach the City Civil & Sessions Court, Dindoshi, Mumbai to file a suit over his allegedly defamatory portrayal in the Netflix series “Ba***ds of Bollywood” directed by Aryan Khan.Justice Vikas Mahajan allowed Wankhede's application seeking liberty in terms of a recent ruling refusing to entertain his defamation...

Delhi High Court Sets Aside Administrative Order Barring Execution Petitions Below ₹2 Crore

The Delhi High Court has held that no litigant can be barred at the threshold from filing execution petitions before the Registry, even in cases where the decree amount is Rs. 2 crore or below.A Division Bench comprising Justice C. Hari Shankar and Justice Om Prakash Shukla set aside an administrative order issued by the Registrar (Original) on November 17, 2016, which directed the Registry...

'Playing With Lives Of General Public': Delhi High Court Denies Bail To Man Booked For Metro Cable Theft

The Delhi High Court has denied bail to a man accused of stealing high-voltage cables from Delhi Metro infrastructure, observing that such acts amount to “playing with the lives of the general public” and have serious implications for public safety.Justice Saurabh Banerjee was hearing the bail application filed by the accused, who is booked under provisions of the Delhi Metro...

Unmarried Granddaughter's Limited Estate Can Enlarge Into Absolute Ownership If Based On Pre-Existing Right: Delhi High Court

The Delhi High Court has recently held that the duty to maintain an unmarried minor daughter of a pre-deceased son may constitute a “pre-existing right” capable of enlarging her limited estate into absolute ownership under Section 14(1) of the Hindu Succession Act, 1956.Justice Purushaindra Kumar Kaurav emphasised that classical Hindu law recognises a continuing familial obligation to...

Delhi Police Opposes Bails In Parliament Security Breach Case, Says Terrorising Minds Of Parliamentarians Can't Be Condoned

The Delhi Police on Monday opposed before the Delhi High Court bail pleas filed by three men accused in the Parliament security breach case which happened on December 13, 2023. The Delhi Police counsel told a division bench headed by Justice Prathiba M Singh that the act of the accused carrying inflammable material in smoke canisters and terrorising the minds of the parliamentarians cannot...