Delhi High Court

High Court Seeks Police Response On Accused Plea Seeking Bail In Delhi Riots Larger Conspiracy Case

The Delhi High Court on Friday issued notice on the bail pleas filed by two accused persons in relation to the 2020 North-East Delhi riots larger conspiracy case.A division bench comprising Justice Prathiba M Singh and Justice Madhu Jain issued notice on the bail pleas filed by accused Athar Khan and Saleem Malik.The Bench sought response of the Delhi Police and directed that status reports...

Exam Fairness Includes Mental Calm: Delhi High Court Allows JEE Aspirant To Reappear As Biometric Glitch Disrupted Exam

The Delhi High Court has recently permitted a JEE 2026 aspirant to reappear in the Main Session-I examination who faced repeated biometric authentication failures, observing that the prejudice suffered cannot be dismissed as insignificant.Justice Jasmeet Singh held that the legitimate fear of being declared ineligible, disqualified, or removed from the examination hall cannot be regarded...

Delhi High Court Quashes CBSE Decision To Scrap 'Additional Subject' Facility For 2025 Class XII Pass-Outs

The Delhi High Court has quashed two CBSE notifications which had withdrawn the facility for Class XII pass-outs of the year 2025 to appear in an “Additional Subject” as private candidates, holding that the decision was arbitrary, retrospectively applied, and violative of the doctrine of legitimate expectation .Justice Jasmeet Singh allowed a batch of petitions filed by students who...

Delhi High Court Asks SSC To Adopt Systematic Approach In Finalizing Question Papers & Answer Keys, Flags Serious Lapses

The Delhi High Court has asked the Staff Selection Commission (SSC) to adopt a more systematic and rigorous approach in framing, vetting and finalising question papers and answer keys in the recruitment examinations. A Division Bench comprising Justice Anil Kshetarpal and Justice Amit Mahajan said that institutionalising a clear and transparent policy for addressing ambiguities and...

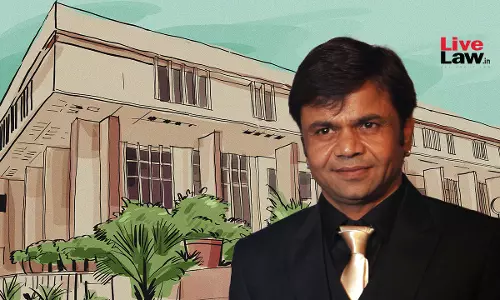

Cheque Bounce Cases: Delhi High Court Raps Actor Rajpal Yadav For Non-Compliance, Directs Immediate Surrender To Tihar Jail

The Delhi High Court on Thursday refused to recall its order directing Bollywood actor Rajpal Naurang Yadav to surrender before the concerned Jail Superintendent in relation to his conviction in cheque dishonour cases.While directing the actor to surrender before the Jail Superintendent, Tihar, immediately today, Justice Swarana Kanta Sharma said that the Court cannot be expected to show...

Mother's Right To Higher Education, Personal Development Can't Be Curtailed Due To Custody Disputes: Delhi High Court

The Delhi High Court has held that a mother's right to personal development, dignity and autonomy, including the pursuit of higher education abroad, is an intrinsic facet of the right to life and personal liberty under Article 21 of the Constitution, and cannot be curtailed merely because custody and visitation proceedings are pending.Justice Saurabh Banerjee held that the fact that a mother...

Delhi High Court Rejects Challenge To Civil Services Prelims 2023, Says Judicial Review In Competitive Exams Extremely Limited

The Delhi High Court has rejected challenge to Civil Services (Preliminary) Examination, 2023, particularly Paper-II (CSAT), observing that judicial review in competitive examinations is extremely limited. A Division Bench comprising Justice Anil Kshetarpal and Justice Amit Mahajan dismissed a batch of petitions filed by various unsuccessful Civil Services aspirants challenging questions...

Delhi High Court To Pass Interim Order Protecting Personality Rights Of Actor-Entrepreneur Vivek Oberoi

The Delhi High Court on Friday said that it will pass an interim order protecting the personality rights of actor and entrepreneur Vivek Oberoi.Justice Tushar Rao Gedela said so after Advocate Sana Raees Khan appeared for the actor in his suit seeking protection of his personality rights.At the outset, the judge remarked: “We will pass orders.”To this, Khan said, "Do I need to make...

Unproven Allegations Of Adultery No Basis To Deny Interim Maintenance Under Domestic Violence Act: Delhi High Court

The Delhi High Court has held that mere allegations of adultery, unsupported by proof, cannot be a ground to deny interim maintenance to a wife under the Protection of Women from Domestic Violence Act, 2005 (PWDV Act). Justice Swarana Kanta Sharma said that unlike Section 125(4) of Cr.P.C., there is no express statutory bar under the DV Act disentitling a woman from seeking reliefs merely on...

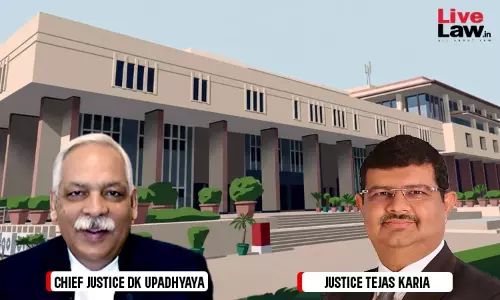

'Manifestly Unreasonable, Arbitrary': Delhi High Court Strikes Down Blanket Ban On Migration Of MBBS Students

The Delhi High Court has quashed Regulation 18 of the Graduate Medical Education Regulations, 2023, which imposed a complete prohibition on migration of MBBS students from one medical college to another.A division bench comprising Chief Justice Devendra Kumar Upadhyaya and Justice Tejas Karia said that Regulation 18 did not pass the constitutional muster as per Article 14 of the Constitution...

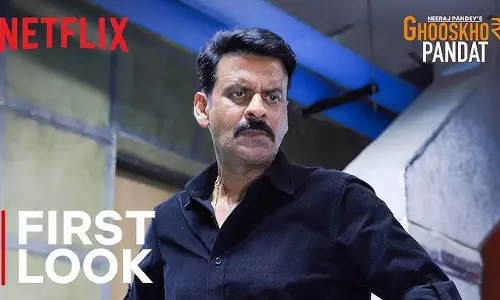

Plea In Delhi High Court Seeks Stay On Netflix Show 'Ghooskhor Pandat', Alleges Collective Defamation Of Brahmin Community

A plea has been filed before the Delhi High Court challenging the proposed release of a Netflix show “Ghooskhor Pandat”. Filed by one Mahender Chaturvedi, who claims to be an Acharya by vocation, the plea alleges that the title and promotional material of the show are defamatory, communally offensive and violative of fundamental rights.The writ petition has been filed against the Union...

Yamuna Pollution: Delhi High Court Sets Aside Jail Term Citing Beneficial Water Act Amendment, Imposes ₹10 Lakh Additional Penalty

The Delhi High Court has upheld the conviction of a Chandni Chowk-based sweet manufacturing unit for discharging untreated effluent into public sewers leading to the Yamuna river.“This Court is mindful that pollution of water bodies, particularly rivers, has serious and long-lasting consequences…Small eateries, restaurants and food processing units, though individually limited in...