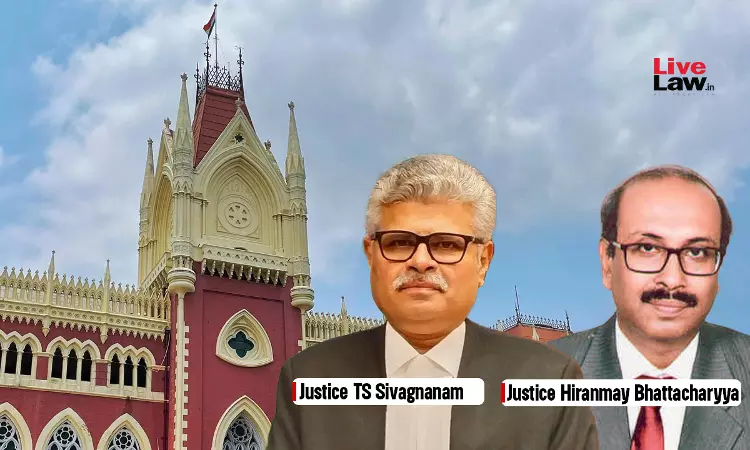

Extended Limitation Can't Be Invoked If No 'Omission' & Suppression Of Material Facts' To Evade Tax : Calcutta HC

Pankaj Bajpai

27 July 2024 8:30 AM IST

Next Story

27 July 2024 8:30 AM IST

The Calcutta High Court held that no service tax will be levied on activities such as cutting or mineral extraction which are part of mining operations, if mining operations are itself not subjected to service tax on the date of levy. The High Court clarified that if the State seeking to recover tax, cannot bring the subject within the letter of law, then it goes without saying that...