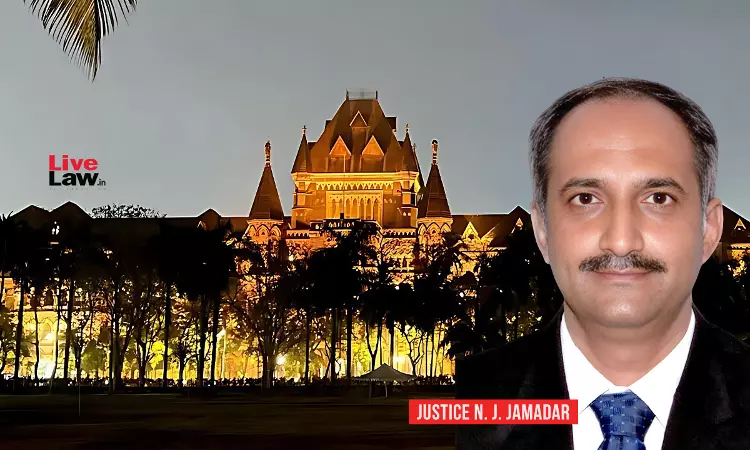

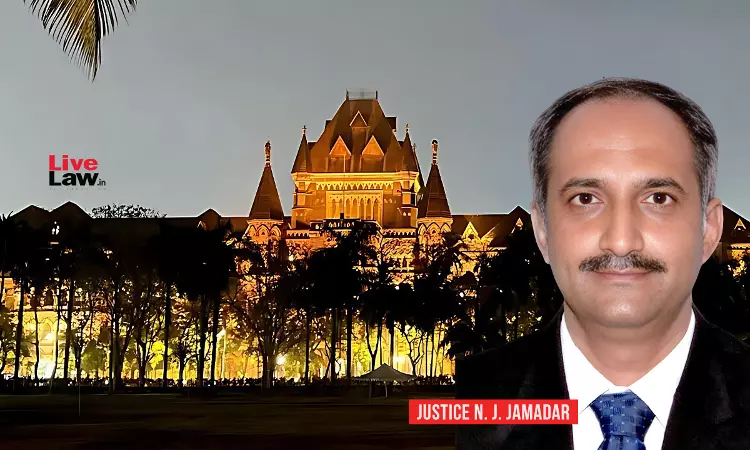

A single judge bench of the Bombay High Court comprising of Justice N. J. Jamadar in the case of Rajiv Bansal & Ors vs State of Maharashtra and Ors has held that withholding of salary or emoluments does not fall within the ambit of offence of cheating Background Facts Rajiv Bansal (Petitioner) was the erstwhile Chairman and Managing Director of Air India Limited (AIL). The...