Long-Term Continuance Of Employment Does Not Create Inherent Right To Regularization: Bombay High Court

Manvir Ahluwalia

9 Jun 2024 12:00 PM IST

Next Story

9 Jun 2024 12:00 PM IST

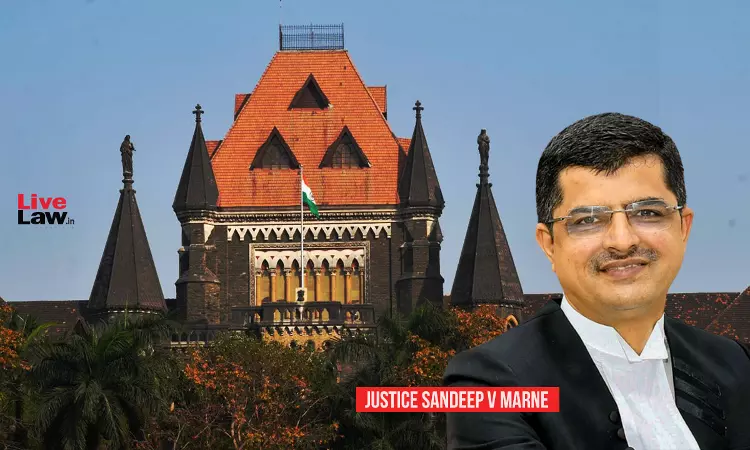

A single judge bench of the Bombay High Court comprising of Justice Sandeep V. Marne while deciding a writ petition in the case of The Chief Officer, Pen Municipal Council & Ors. v. Shekhar B. Abhang & Ors. has held that regularization of services cannot be claimed merely based on long-term continuance of employment as this does not create any inherent right...