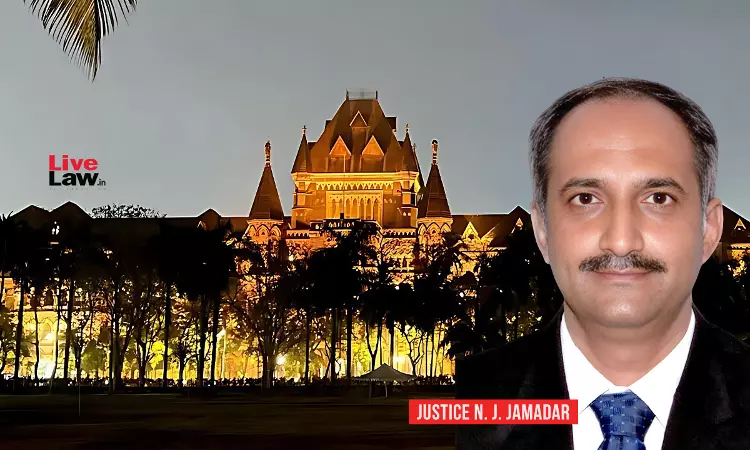

The Bombay High Court allowed refund of stamp duty for a flat purchase agreement to a man in his late 60s despite cancellation of the agreement beyond the limit of 5 years under the Maharashtra Stamp Act, as the developer neither developed the building nor cancelled the agreement in time.Justice NJ Jamadar observed that the petitioner had diligently pursued remedies before RERA and the delay...