All High Courts

Centre Notifies Appointment Of Advocate As Judge Of Patna High Court

The Central Government on Friday (January 23) notified the appointment of senior advocate Anshul Raj as a judge of Patna High Court. Union Law Minister Arjun Ram Meghwal took to X to notify the appointment:"In exercise of the power conferred by the Constitution of India, the President of India, after consultation with Chief Justice of India, is pleased to appoint Shri Ansul @ Anshul Raj,...

Trial Judge Bribery Case: Punjab & Haryana High Court Allows Realtor Roop Bansal To Withdraw Quashing Plea; Slaps ₹1 Lakh Cost

The Punjab and Haryana High Court has permitted real estate developer Roop Bansal to withdraw his petition challenging the FIR lodged against him for conspiring to bribe a Trial Court judge.Bansal is booked under provisions of the Prevention of Corruption Act and for criminal conspiracy under Section 120B IPC.His first plea for quashing of FIR was was withdrawn in February to file it afresh,...

Bombay High Court Proposes Stopping Salaries Of BMC, NMMC Commissioners For Their Failure To Contain Air Pollution Levels

The Bombay High Court on Friday criticised the Brihanmumbai Municipal Corporation (BMC) and the Navi Mumbai Municipal Corporation (NMMC) for the failure to bring down the rising levels of air pollution in Mumbai and neighbouring areas and therefore indicated that it may on the next date, pass 'coercive' orders of stopping the salaries of the Commissioners of both Mumbai and Navi Mumbai....

Failure To Disclose Specific 'Grounds Of Arrest' In Memo Is Dereliction Of Duty; Errant Cops Must Be Suspended: Allahabad High Court

In a significant order passed on Thursday, the Allahabad High Court has directed that any police officer in the state who fails to disclose specific "grounds of arrest" in the arrest memo shall be liable for departmental proceedings after being placed under suspension. A bench of Justice Siddharth and Justice Jai Krishna Upadhyay observed that "empty compliance" of the law by...

Undisclosed Income: Madras High Court Reserves Orders On Actor Vijay's Challenge To ₹1.5 Crore Income Tax Penalty

The Madras High Court has reserved orders on a plea filed by Actor Vijay challenging the Rs. 1.5 crore penalty imposed on him by the Income Tax Department for undisclosed income of Rs 15 crore in the financial year 2015-16. Justice Senthilkumar Ramamoorthy reserved orders on Friday. Another bench of the court had previously stayed the proceedings in 2022.It all goes back to income...

Can't Yield To Lawbreakers: Karnataka High Court Asks Police, Organizer To Discuss Measures For 'Peaceful' Conduct Of Traditional Fair

The Karnataka High Court on Friday (January 23) directed the concerned police inspector and administration of Chithradurga district to convene a meeting with the organizers of a traditional fair in the area so as to ensure that it is conducted peacefully. In doing so the court observed that the administration cannot give into the conduct of a few persons who may try to create a law and...

'Video Journalists Must Adhere To High Ethical Standards': Madras High Court Says While Imposing Strict Bail Conditions On Savukku Shankar

The Madras High Court on Friday (January 23) observed that video journalists should conduct themselves with high ethical standards to maintain public trust. The court added that in the digital age, the video journalists were in front line in combating misinformation and disinformation. “...this Court wishes to observe that video journalists must adhere to high ethical standards...

Business To Ply Bike Taxis Protected Under Article 19(1)(g), State Can Impose Reasonable Restrictions But No Blanket-Ban: Karnataka High Court

The Karnataka High Court on Friday (January 23) upheld taxi aggregators' right to business of plying bike taxis observing that it is a legitimate business protected under Article 19(1)(g) of the Constitution, adding that a blanket-ban by the State is not a reasonable restriction under Article 19(6).In doing so the court set aside a single judge's order which held that bike taxis cannot operate...

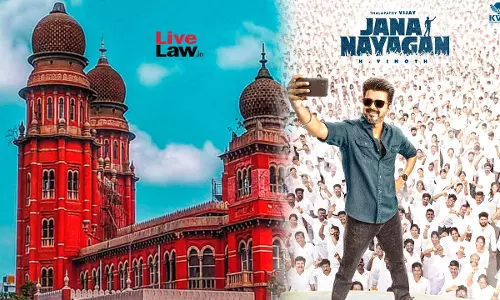

Jana Nayagan Censor Certificate Row: Madras High Court To Pronounce Orders On CBFC's Appeal On January 27

The Madras High Court will pronounce orders on 27th January (Tuesday) on appeals filed by the Central Bureau of Film Certification (CBFC) challenging a single judge's order directing it to forthwith grant "UA" certification for actor-politician Vijay's Jana Nayagan movie. The bench of Chief Justice Manindra Mohan Shrivastava and Justice G Arul Murugan will pronounce orders on Tuesday morning....

Punjab & Haryana High Court Takes Suo Moto Cognizance Of Attacks, Thefts Targeting Advocates

The Punjab and Haryana High Court has taken suo motu cognisance of a spate of attacks and thefts targeting advocates, amid growing concern within the legal fraternity over their safety and the alleged lack of effective police action.Division bench of Chief Justice Sheel Nagu and Justice Sanjiv Berry sought status report from Chandigarh and Punjab Police authorities.A letter was written by...

Karnataka High Court Grants Bail To Man Booked For Murder Of Labourer Who Allegedly Raised 'Pakistan Zindabad' Slogan During Cricket Match

The Karnataka High Court has granted bail to an accused in a case relating to the death of a person, a daily wager from Kerala, who was allegedly assaulted by a group after he raised the slogan “Pakistan Pakistan Zindabad” during a local cricket match in Mangaluru.Justice Shivashankar Amarannavar granted bail to Natesh Kumar, who was one of the accused, and directed his release in an...

Arbitration | 'Substantial Financial Interest' No Ground To Implead Non-Signatory; Active Participation In Contract Essential: HP High Court

The Himachal Pradesh High Court has ruled that merely because a party has a substantial financial interest in the subject matter of the contract, that alone cannot be a ground for impleading it as a party in the arbitration proceedings between the parties before the learned Arbitrator.The HC thus upheld an arbitral tribunal's decision rejecting the impleadment application of a non-signatory...