All High Courts

Madhya Pradesh High Court Weekly Roundup: January 19 - January 25, 2026

Citations: 2026 LiveLaw (MP) 21 to 2026 LiveLaw (MP) 32Nominal IndexCP v State of Madhya Pradesh 2026 LiveLaw (MP) 21Naresh Sawnla v State of Madhya Pradesh 2026 LiveLaw (MP) 22Nasir v State of Madhya Pradesh 2026 LiveLaw (MP) 23Satyabir Singh v MP Industrial Development Corporation 2026 LiveLaw (MP) 24Ramgopal Sakhwar v State of Madhya Pradesh 2026 LiveLaw (MP) 25Rakesh Kumar Shukla v State...

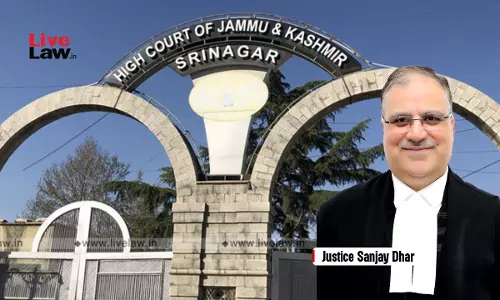

Right Of Pre-Emption Is 'Extremely Weak', Filing Injunction Suit Without Claiming It Amounts To Waiver : J&K&L High Court

The Jammu & Kashmir and Ladakh High Court has reiterated that the right of pre-emption is a very weak right, which can be lawfully defeated by a purchaser and can also be waived by the pre-emptor through conduct, as inferred from the facts and circumstances of a case.Setting aside a judgment and decree passed by the District Judge, Poonch, in 2001, the Court held that a pre-emptor who...

Trial Can't Proceed Without Deciding Plea Of Unsoundness Of Mind Under BNSS: Rajasthan High Court

The Rajasthan High Court has set aside a trial court order directing continuation of trial merely based on medical report concluding the petitioner to be of sound mind, without any reasoned adjudication on the application filed under Section 368 BNSS.Section 368 BNSS lays down the procedure for trial of a person of unsound mind. The bench of Justice Anil Kumar Upman observed that...

Writ Court Under Article 226 Examines Decision-Making Process, Not Merits: Gauhati High Court Refuses To Interfere With PDS Licence Cancellation

The Gauhati High Court declined to interfere with the cancellation of a fair price shop (PDS) licence, holding that its writ jurisdiction under Article 226 is confined to examining the decision-making process and not the merits of the decision, and finding that no case for interference was made out.Justice Sanjay Kumar Medhi, presiding over the case, said, “The certiorari jurisdiction to...

Rajasthan High Court Slams Lawyers' Strike Over Working Saturdays, Says Boycott Of Courts Violates Litigants' Rights Under Article 21

The Rajasthan High Court has frowned upon lawyers' strike to protest against its decision making two Saturdays working in every month, reiterating that lawyers have no right to strike especially when the matter involves personal liberty of citizens.The bench of Justice Anoop Kumar Dhand held that when lawyers boycott Courts, it results in direct violation of the litigants' rights to...

Indore Water Contamination Case: MP High Court Orders Probe By Retired HC Judge

Dealing with a lawyer's plea concerning the recent water crisis in Indore, the Madhya Pradesh High Court on Tuesday (January 27) constituted a one-man Judicial Commission headed by Retired Justice Sushil Kumar Gupta to inquire into the issues relating to water contamination in Bhagirathpura, Indore, and its impact on other areas of the city.The division bench of Justice Vijay Kumar Shukla...

Gasifier Crematorium Is Only To Benefit Community: Madras High Court Dismisses Plea Against Construction Of Crematorium By Isha Foundation

The Madras High Court recently dismissed a plea challenging the construction of Kalabhairavar Dhagana Mandapam by the Isha Foundation. The bench of Chief Justice Manindra Mohan Shrivastava and Justice G Arul Murugan noted that the Tamil Nadu Village Panchayats (Provision of Burial and Burning Grounds) Rules, 1999 did not prohibit granting of license for crematorium within 90...

Marriage Registration Not Proof Of Marital Harmony, Can't Be Used To Deny Mutual Divorce Before One Year: Delhi High Court

The Delhi High Court has held that mere registration of marriage between two individuals cannot determine matrimonial harmony or their intention to cohabit together. “Registration of marriage is merely a statutory mandate, and by itself, cannot be determinative of matrimonial harmony, intention to cohabit, or the viability of the marital relationship,” a division bench comprising...

Attempt To Hoodwink Court: Delhi HC Rejects Anticipatory Bail Application Noting Parallel Plea Before Sessions Court

The Delhi High Court dismissed an anticipatory bail application after finding that the accused had filed parallel anticipatory bail pleas before two different courts, which were being heard on the same day, terming the conduct a "clear abuse of process in the name of liberty".A bench of Justice Girish Kathpalia observed that there was no acceptable explanation for filing two anticipatory...

Sabarimala Gold Theft: Kerala High Court Criticises SIT For Delay In Filing Chargesheet Leading To Accused Being Released On Default Bail

The Kerala High Court on Tuesday (January 27) orally criticised the Special Investigation Team for its delay in submitting the final report in the Sabarimala gold theft case, which has led to some of the accused being released on statutory bail.Recently, the prime accused Unnikrishnan Potty was granted statutory bail in one of the cases and Murari Babu was also granted default bail by the...

Supreme Court's 'Mihir Rajesh Shah' Ruling On Written Grounds Of Arrest Operates Prospectively: Delhi High Court

The Delhi High Court has held that the Supreme Court's judgment in Mihir Rajesh Shah v. State of Maharashtra (2025), which mandates the furnishing of written grounds of arrest to an accused before remand in all offences, will operate prospectively and cannot be applied to arrests made prior to the date of the ruling.The Division Bench of Justices Vivek Chaudhary and Manoj Jain thus dismissed...

Bombay High Court Mulls Constituting Compliance Committee As Authorities Drag Feet On Air Pollution 'Crisis'

The Bombay High Court on Tuesday (January 27) orally expressed reluctance to monitor the efforts taken by the Brihanmumbai Municipal Corporation (BMC), Maharashtra Pollution Control Board (MPCB) and other authorities in bringing down the rising levels of air pollution in Mumbai and its neighbouring areas, stating that it cannot sit in the court and check if the compliances are made.The...