All High Courts

S.138 NI Act | Only Payee Or Holder In Due Course Can File Complaint; 3rd Party Lacks Locus Even If Transaction Affects Him: Allahabad HC

The Allahabad High Court on Wednesday clarified that a complaint under Section 138 of the Negotiable Instruments Act, 1881, is not maintainable by a third party even if the transaction affects him and that the same must be filed either by the payee or the holder in due course of the cheque. The bench of Justice Samit Gopal added that an authorised representative of the payee or holder...

Karnataka High Court Allows Mother To Approach MEA For OCI Card To Enable Aadhaar For US-Born Child

The Karnataka High Court on Wednesday (January 28) permitted a woman to file an application with Ministry of External Affairs for issuing an OCI card for her USA born son–residing presently in India–which would be a required document for issuing an Aadhaar card in her son's favour. The court was hearing the minor boy's plea–represented by his mother–seeking a direction to the...

Poverty Can't Defeat Liberty: Rajasthan High Court Recalls ₹1 Lakh Deposit Condition, Orders Release Of NDPS Convict

The Rajasthan High Court has recalled the monetary condition imposed on the release of the applicant, an NDPS convict, owing to which he was not able to get out of jail, despite being released from prison on bail after around 8 years, and directed the trial court to release him. The bench of Justice Anoop Kumar Dhand held that poverty and penalty should not hinder the right to life and...

Non-Disclosure Of Prior Live-In Relationship Amounts To 'Fraud' U/S 12(1)(c) Of Hindu Marriage Act: Jharkhand High Court

The Jharkhand High Court has held that the non-disclosure of a prior live-in relationship before marriage constitutes fraud as to a material fact under Section 12(1)(c) of the Hindu Marriage Act, 1955. The Court emphasised that while Hindu marriage is a sacrament and not a contract, the concealment of such a relationship to obtain consent renders the marriage voidable and liable to be annulled...

Probationers Are 'Workmen' Under Industrial Disputes Act; S. 17B Wages Non-Recoverable Even If Termination Upheld: Delhi High Court

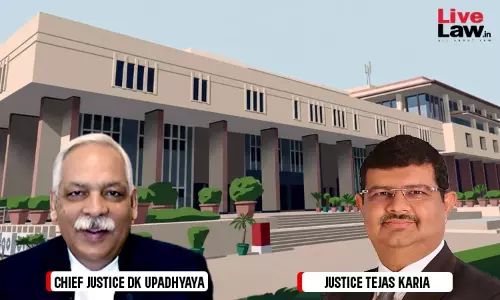

The Delhi High Court has held that while a probationary employee falls within the definition of a 'workman' under Section 2(s) of the Industrial Disputes Act, 1947, the termination of a probationer without a full-scale formal departmental inquiry is legally valid if the order is one of termination simpliciter and non-stigmatic.A Bench of Chief Justice DK Upadhyaya and Justice Tejas Karia...

High Courts Shouldn't Issue Routine Directions For Early Disposal Of Cases, Must Consider Urgency Involved: Madras High Court

The Madras High Court recently observed that higher courts should not mechanically issue directions to the authorities for early disposal of petitions and should consider the urgency required in each cases. “Therefore, the High Court, while issuing a direction to dispose of the cases by the District Courts, statutory Authorities, etc. has to take into consideration the...

Relationship No License To Exploit Partner's Dignity: Jharkhand HC Denies Anticipatory Bail To Man Accused Of Sending Obscene Content To Employer

The Jharkhand High Court has rejected an anticipatory bail application filed by a man accused of creating fake email and social media accounts to circulate defamatory and obscene content of a woman with whom he was allegedly in a consensual extra-marital relationship.The Court observed that even if a relationship exists, it cannot be termed as a "friendship simpliciter" if one party exploits...

Age Bar Under Assisted Reproductive Technology Act Applies To Individuals, Not Couples: P&H High Court Allows IVF To Bereaved Parents

The Punjab and Haryana High Court has set aside an order denying Assisted Reproductive Technology (ART) services to a married couple who lost their only son in 2024, holding that the ART Act, 2021 does not prescribe an age limit for a commissioning couple and expressly permits the use of donor oocytes.Allowing the writ petition, the Court quashed the order dated 06 February 2025 passed by...

Freedom Of Speech No Licence To Defame Or Run Malicious Campaigns On Social Media: Delhi High Court

The Delhi High Court has observed that while freedom of speech is a cherished constitutional right, it does not extend to publishing defamatory, abusive or malicious content on social media platforms under the guise of free expression.Justice Jyoti Singh said that the right to free expression cannot be exercised to trample upon rights of others, particularly, right to reputation, which is also...

'Who Is Safe?' Karnataka High Court Refuses To Quash FIR Against Man Accused Of Taking Woman's Photos Inside Trial Room

The Karnataka High Court on Tuesday (January 27) refused to entertain a plea for quashing an FIR lodged against a man accused of clicking photographs of a woman while she was in the trial room of a clothing shop in Bengaluru. The petitioner had moved a plea seeking quashing of a 2024 FIR registered by the police for offence of voyeurism under Section 77 BNS. In the interim the petition sought...

Calcutta High Court Quashes Case Against Child For Driving Car With Blue Beacon And 'Judge' Sign As JJ Act Inquiry Exceeded Time Limit

The Calcutta High Court has quashed proceedings initiated under the Juvenile Justice Act against a child driving a four-wheeler with a blue beacon and a dashboard sign reading "judge", after noting that the inquiry had remained inconclusive beyond the four months prescribed under Section 14(2) of the JJ Act.The bench of Justice Ajoy Kumar Mukherjee observed,"The consequence of the failure...

'At Least Final Report Should Be There': Kerala High Court Says FIRs In Other Rape Cases Not Antecedents Against MLA Rahul Mamkootathil

The Kerala High Court on Wednesday (January 28) reserved its verdict in the anticipatory bail plea preferred by Palakkad MLA Rahul Mamkootathil in rape and miscarriage case.Subsequent to the registration of the present crime, two other complaints alleging him of rape have been filed by two different women, which the prosecution argued has to be taken as criminal antecedents.Dr. Justice...