Editors Pick

DU Photocopying Appeal: Who Said What And Why?

The Delhi High Court has reserved its verdict in the Delhi University (DU) photocopy case.A group of international publishers, including Oxford University Press, Cambridge University Press and Taylor and Francis Group, appealed against the September 16 single judge ruling.Justice Rajiv Sahai Endlaw had allowed Rameshwari Photocopy Services, a shop in the DU campus, to sell course packs...

In A Full Bench Judgment, Bombay HC Holds That A Hindu Can Re-Marry 90 Days After Divorce [Read Judgment]

A full bench of the Bombay High Court has held that a Hindu can marry 90 days after his/her marriage has been dissolved through a decree, provided no appeal is pending against the decree. The primary question before the full bench comprising of Justice Naresh Patil, Justice RD Dhanuka and Justice Sadhana Jadhav was that whether an appeal under Section 19(1) of the Family Courts Act, 1984 will...

Ensure Video Conferencing Facility In All Courts By March End, Bombay HC Tells Maharashtra Government

The Bombay High Court has directed the Maharashtra government to install video conferencing facilities in all courts in the state by the end of March 2017. These directions came while the division bench of Justices VM Kanade and Nutan Sardesai was a hearing a criminal PIL filed in 2011 after court took suo-motu cognizance of a letter written by Shaikh Abdul Naeem, one of the accused in...

Delhi HC Imposes Rs. 3-Lakh Costs On Petitioner For Filing Successive Writ Petitions On Same Issue [Read Judgment]

This concept of filing a new writ petition essentially for getting earlier admitted writ petitions heard is an unheard concept and argument and needs to be put down with heavy hands, the Court said.The Delhi High Court has imposed an exemplary cost of Rs. 3 lakh on a person who had filed successive writ petitions on the same issue, for getting earlier admitted writ petitions heard.Justice...

Use Of Aadhaar To Get Mobile SIM Connections: Legal Issues Involved

These days, telecom operators are relying on Aadhaar data for customer verification before activating SIM cards. Reliance Jio, which is creating waves in the telecom field, is making use of this facility to its fullest potential. Operators like Airtel and Vodafone have also started to make use of Aadhaar date. Ever wondered how such private players are able to make use of Aadhaar data containing personal and sensitive information? Are there any regulations in place to ensure that nothing...

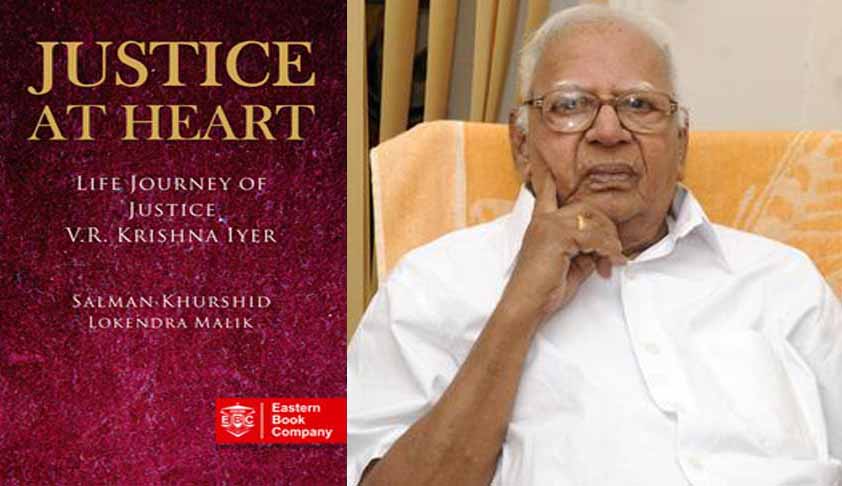

Justice Krishna Iyer: A Remarkable Blend Of Judicial And Humanistic Approach To Life And Its Problems

On December 5, we will be observing the second anniversary of the passing away of Justice V.R.Krishna Iyer. The two years since his passing away have seen an extraordinary interest in the contribution of Justice Iyer to Indian Supreme Court’s jurisprudence, and to the quality of India’s public discourse, after his retirement. Although his tenure in the Supreme Court lasted only for...

#Demonetisation: Cash Withdrawal Restrictions A Policy Decision, Can’t Interfere: Delhi HC [Read Order]

Restriction is only with regard to withdrawal in the form of cash, the bench said.The Delhi High Court has dismissed a plea against restriction imposed on cash withdrawal as part of the demonetisation drive, observing that it is a policy decision by the Central government and is beyond the scope of powers of judicial review.Petitioner Ashok Sharma contended that the money, which had been...

Delhi HC Quashes Centre's Ban On 344 Combination Drugs [Read Judgment]

In a landmark judgment with strong repercussions for the government, the Delhi High Court on Thursday quashed a Central Government Order (CGO) banning 344 fixed dose combinations (FDCs) of drugs.Authored by Justice Rajiv Sahai Endlaw, the judgment answered various challenges raised in 454 petitions from various pharmaceutical companies after the Centre's decision to ban the drug...

Sree Padmanabhaswamy Temple Eases Dress Code For Women [Read Order]

Women devotees wearing churidars or salwar kameez would, henceforth, be allowed to enter Sree Padmanabhaswamy Temple in Thiruvananthapuram without the need to wear a dhoti over her garments.The decision of the Executive Officer was in pursuance to the orders of the Kerala High Court dated 29th September, directing a thorough deliberation on the matter and reaching a just...

No Seizure Of Gold Jewellery To Extent Of 500 Gms Per Married Lady, 250 Gms Per Unmarried Lady And 100 Gms Per Male: FM

The Finance Ministry has clarified that the Taxation Laws (Second Amendment) Bill, 2016 has not introduced any new provision regarding chargeability of tax on jewelry."The Bill only seeks to enhance the applicable tax rate under section 115BBE of the Income-tax Act, 1961 (the Act) from existing 30% to 60% plus surcharge of 25% and cess thereon. This section only provides rate of tax to be...

Delhi HC Refuses To Set Aside Circular Laying Down Conditions For Withdrawal In Weddings Post-Demonetisation [Read Order]

Delhi High Court yesterday dismissed a petition seeking quashing of the RBI circular dated November 21. This circular allowed withdrawal of Rs. 2.5 lakh for weddings, however in order to establish that the persons for whom the payment is proposed to be made conditions were imposed under paragraph 2(vi)(c) with regard to the limits of cash withdrawal for the purpose of celebration of...

Son Has No Legal Claim On Parents’ House, Can Stay Only Till They Allow: Delhi HC [Read Judgment]

A son can reside in a self-acquired property of his parents so long as they desire and cannot claim a legal right to stay there, irrespective of his marital status, ruled the Delhi High Court in its latest judgment.Justice Pratibha Rani expressly stated, “Where the house is a self-acquired house of the parents, a son, whether married or unmarried, has no legal right to live in that house and...

![In A Full Bench Judgment, Bombay HC Holds That A Hindu Can Re-Marry 90 Days After Divorce [Read Judgment] In A Full Bench Judgment, Bombay HC Holds That A Hindu Can Re-Marry 90 Days After Divorce [Read Judgment]](https://www.livelaw.in/cms/wp-content/uploads/2016/04/Bombay-High-Court-LiveLaw.jpg)

![Delhi HC Imposes Rs. 3-Lakh Costs On Petitioner For Filing Successive Writ Petitions On Same Issue [Read Judgment] Delhi HC Imposes Rs. 3-Lakh Costs On Petitioner For Filing Successive Writ Petitions On Same Issue [Read Judgment]](https://www.livelaw.in/cms/wp-content/uploads/2015/10/Delhi-High-Court-min.jpg)

![#Demonetisation: Cash Withdrawal Restrictions A Policy Decision, Can’t Interfere: Delhi HC [Read Order] #Demonetisation: Cash Withdrawal Restrictions A Policy Decision, Can’t Interfere: Delhi HC [Read Order]](https://www.livelaw.in/cms/wp-content/uploads/2016/11/Currency-Demonitisation.jpg)

![Delhi HC Quashes Centres Ban On 344 Combination Drugs [Read Judgment] Delhi HC Quashes Centres Ban On 344 Combination Drugs [Read Judgment]](https://www.livelaw.in/cms/wp-content/uploads/2016/02/Online-Sale-of-Drugs-min.jpg)

![Sree Padmanabhaswamy Temple Eases Dress Code For Women [Read Order] Sree Padmanabhaswamy Temple Eases Dress Code For Women [Read Order]](https://www.livelaw.in/cms/wp-content/uploads/2014/04/padmanabha-swamy-temple_0.jpg)

![Son Has No Legal Claim On Parents’ House, Can Stay Only Till They Allow: Delhi HC [Read Judgment] Son Has No Legal Claim On Parents’ House, Can Stay Only Till They Allow: Delhi HC [Read Judgment]](https://www.livelaw.in/cms/wp-content/uploads/2015/10/Delhi-High-Court-min1.jpg)