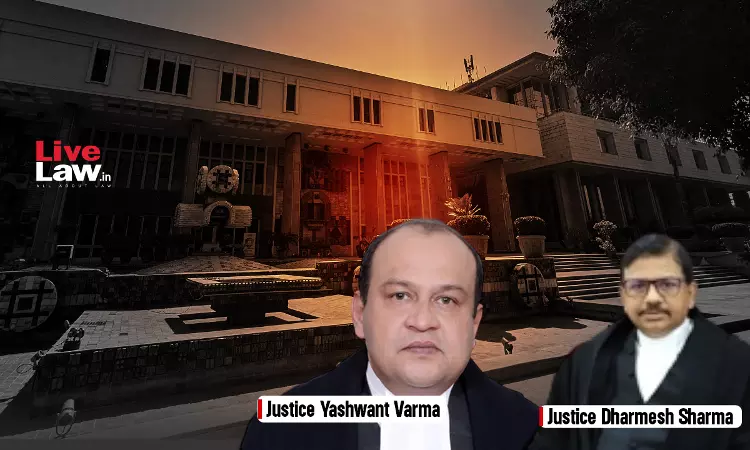

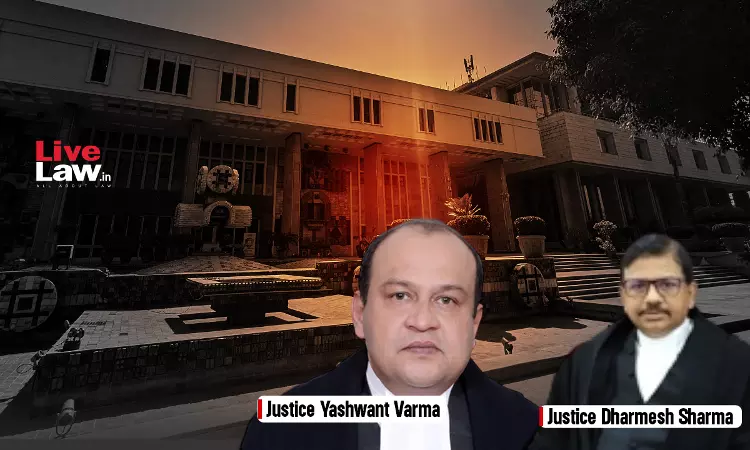

The Delhi High Court bench of Justice Yashwant Varma and Justice Dharmesh Sharma, while hearing a review petition of an appeal filed by the appellant u/s 37(1)(b) of the A&C Act read with Section 13 of the Commercial Court Act observed that the exuberant interest rate charged in the commercial world depends upon the transparency of the terms and conditions of the contract entered...