An Overview On The Prevention Of Corruption (Amendment) Act 16 of 2018 [Part-1] Section 7

Justice V. Ramkumar

19 Nov 2018 12:10 PM IST

![An Overview On The Prevention Of Corruption (Amendment) Act 16 of 2018 [Part-1] Section 7 An Overview On The Prevention Of Corruption (Amendment) Act 16 of 2018 [Part-1] Section 7](https://www.livelaw.in/cms/wp-content/uploads/2016/08/Parliament-Cover-pic.jpg)

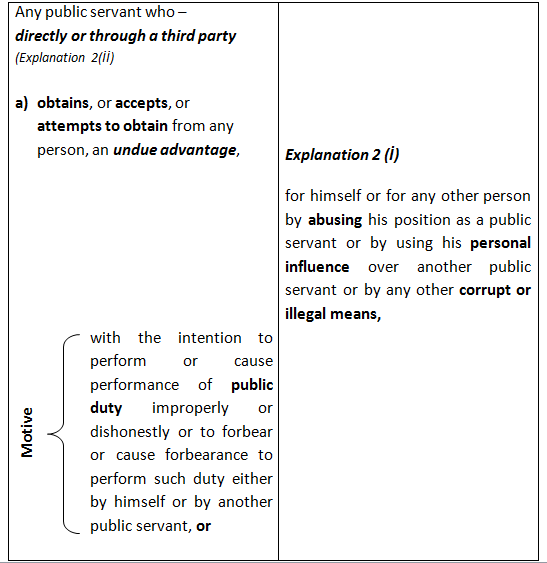

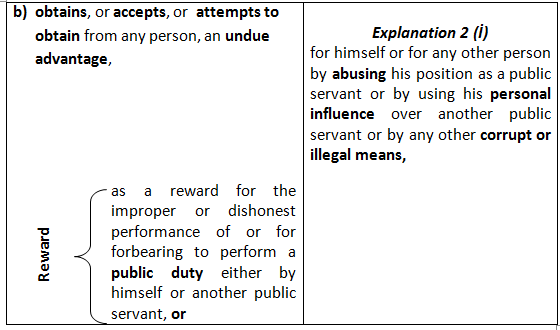

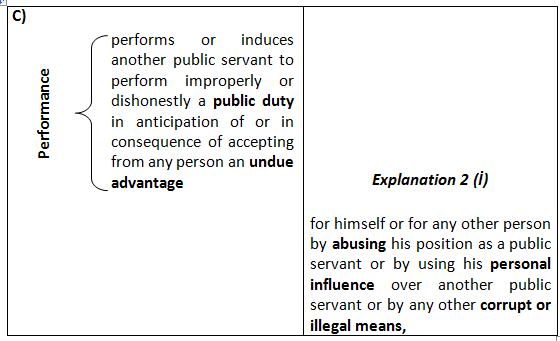

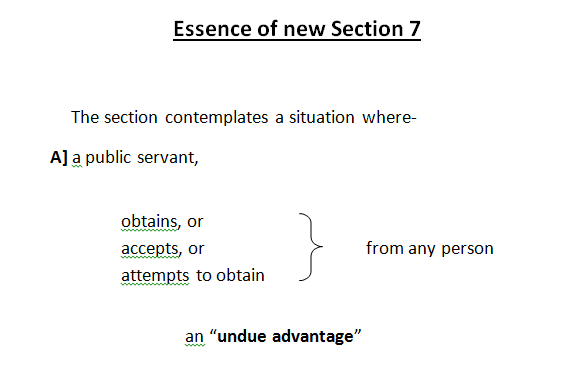

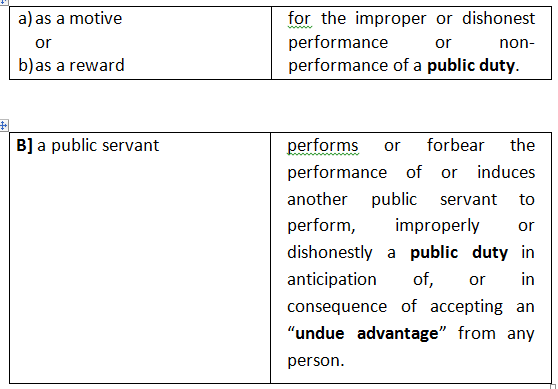

New Section 7 substituted by Amending Act 16/2018 7-Offence relating to public servant being bribed.

commits an offence under this section.

The punishment is imprisonment for not less than 3 years but upto 7 years AND fine. While fixing the fine the matters under new Section 16 will have to be taken into consideration. Eventhough new Section 9 (4) does not specify that the offence is cognizable, going by Part II of Schedule 1 of Cr.P.C the offence is cognizable and non-bailable. The ingredient of attempt to obtain undue advantage in new Section 7 could have been taken out of the Section and included in new Section 15.

There is a rebuttable presumption under Section 20 that if it is proved in a trial of an offence under Section 7 that the accused did any of the 3 things under Section 7, he did those things as a motive or reward under Section 7 for performing or causing performance of a public duty improperly or dishonestly either by himself or by another public servant, or any undue advantage without consideration or for a consideration which he knows to be inadequate under Section 11.

Explanation 1 - The doing of any of the 3 things under Section 7 shall constitute an offence even if the performance of a public duty by the public servant is not, or has not been improper.

(Note: What the section requires is that the performance of the public duty should be improper or dishonest. But this Explanation says that even if the public duty is performed properly, it would amount to an offence if the public servant does any of the 3 things envisaged by the section. The illustration which says that a public servant asking a person Rs.5000/- for processing his routine ration card application, commits an offence under this section, clarifies the position. It may be noted that the expression “improperly” is not defined.)

New Section 7(a) is attracted only when undue advantage is obtained or accepted or attempted to be obtained as a motive for the future performance or non-performance or improper or dishonest performance of a public duty. The said motive is supplied by new Section 20. Similarly, new Section 7 (b) is attracted when undue advantage is obtained or accepter or attempted to be obtained as a reward for the past performance, non-performance or improper or dishonest performance of a public duty. The said reward is supplied by new Section 20. New Section 7 (c) actually deals with the execution of the act of performing or not performing or dishonest or improper performance of the public duty either before or after accepting the undue advantage. A closer examination will show that new Sections 7(a) and 7(b) are really included in new Section 7(c). The title of new Section 7 which reads “offence relating to public servant being bribed” does not appear to be appropriate. It could have been “A public servant securing an undue advantage in the performance of public duty”. The present title of new Section 7 will appropriately fit in for the new Section 8.

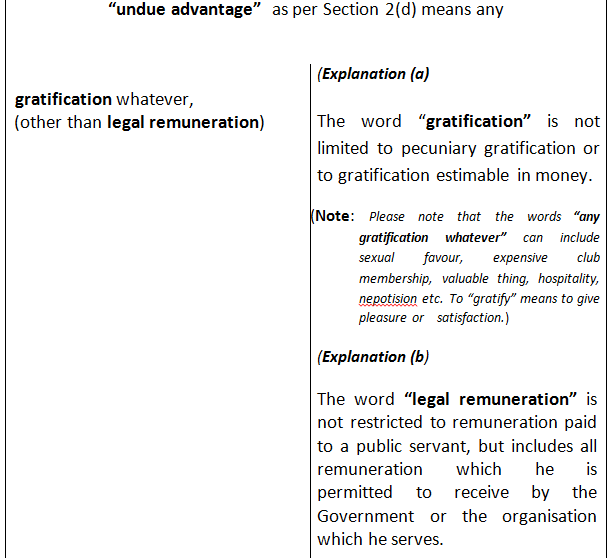

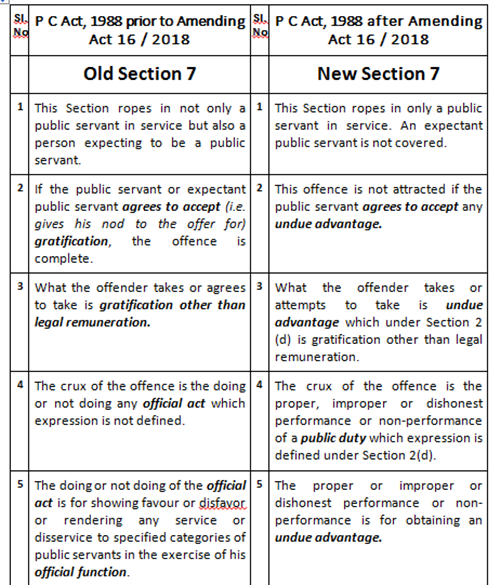

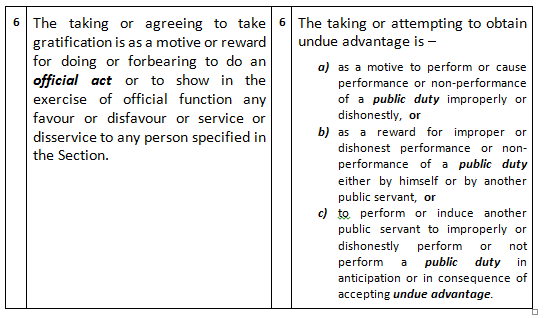

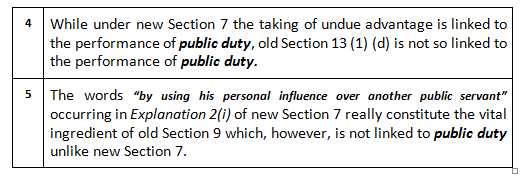

This new Section 7 somewhat but not fully merges old Section 7 and old Section 13 (1) (d). The expression “undue advantage” in new Section 7 and as defined under new clause (d) of Section 2 takes in “gratification”. Under old Section 7 it was the doing or not doing any official act (not defined) in the exercise of his official functions which was the crux of the provision. But under new section 7 it is the performance or non-performance of a public duty (which expression has been defined under Section 2(b), that is significant. In my opinion, doing an official act in the exercise of official functions under old Section 7 was wider than the performance of public duty under new Section 7 because “public duty” as defined under Section 2 (b) can only mean a duty in the discharge of which the State, the public or the community at large has an interest. While old Section 7 was wide enough to take in an act of showing favour to an individual by a public servant during his exercise of official function in a matter which concerns only the personal interest of the individual without involving any public interest, new Section 7 would be attracted only if the act of showing favour or disfavour involved public interest. It may not be possible to read public interest in each and every official act of showing favour or disfavour or rendering service or disservice to an individual applicant or service-seeker. Again under old Section 7 if the public servant agreed to accept any gratification, it would attract the penal consequences. But under new Section 7 the words “agrees to accept” are absent. A person expecting to be a public servant was covered by old Section 7. But, an expectant public servant is not covered by new Section 7. Now taking old Section 13 (1)(d), it can be seen that in the place of “valuable thing” or “pecuniary advantage” in old Section 13 (1) (d), what is substituted by new Section 7 is “undue advantage”, the definition of which in new Section 2(d) is capable of roping in “valuable thing” and “pecuniary advantage”. The ingredient of “corrupt or illegal means” and “abusing his position as a public servant” occurring in clauses (i) and (ii) of old Section 13 (1)(d), is supplied by Explanation 2 (i) of new Section 7. But the doing of any of the 3 things under new Section 7 is for the performance or non-performance or improper or dishonest performance of public duty as defined under Section 2(b). Similarly, clause (iii) of old Section 13 (1) (d) which says that a public servant while holding office as such obtains for any person any valuable thing or pecuniary advantage without any public interest, is absent in new Section 7. Again, a public servant using his personal influence over another public servant is a common ingredient of clauses (a) and (b) of new Section 7 in view of Explanation 2(i) of new Section 7 and the same is a vital ingredient of old Section 9 as well. The following chart will indicate the distinction between old Section 7 and new Section 7:-

Similarly, whether offences under Sections 9 and 13 (1) (d) of the P.C Act, 1988 prior to Amending Act 16 of 2018, have been taken in by new Section 7 can now be examined :-

Thus, old Sections 7, 9 or 13 (1) (d) are not strictly and wholly substituted or covered by new Section 7. If so, the new Section 7 which partly takes in old Section 7, old Section 9 and old Section 13(1) (d) does not completely repeal old Section 7 or old Section 9 or old Section 13(1) (d). In other words, any pending investigation or prosecution under old Sections 7, 9 and 13 (1) (d) is unaffected by Amending Act 16 of 2018. Even if the new Section 7 has the effect of completely repealing old Sections 7, 9 and 13 (1) (d), in the absence of a different intention in Amending Act 16 of 2018, the Amending Act has no application to a pending proceeding under old Sections 7, 9 and 13(1) (d). (Vide Section 6 (e) of the General Clauses Act 1897.

By virtue of Section 6A of the General Clauses Act, 1897, the word “repeal” will take in an omission, substitution or insertion in the newly enacted Amending Act.

If a later statute again describes an offence created by an earlier statute and imposes a different punishment or varies the procedure, the earlier statute is repealed by implication. (vide Zaverbhai v. State of Bombay – AIR 1954 SC 752; T. Barai v. Henry Ah Hoe – AIR 1983 SC 150; Dharangdhara Chemical Works v. Dharangdhara Municipality – (1985) 4 SCC 92 at pages 99, 100). Where the offence described in the later enactment is not the same as described in the earlier enactment there is no repeal by implication. (vide Om Prakash v. State of U.P – AIR 1957 SC 458; M. Karunanidhi v. Union of India – AIR 1979 SC 898; T. Barai v. Henry Ah Hoe – AIR 1983 SC 150). Therefore, if the essential ingredients of both the offences are different, (as in the case of old Sections 7, 9 and 13 (1) (d) in contradistinction to new Section 7) there is no implied repeal and consequently the investigation or prosecution of the offence under the old law, are unaffected by the Amending Act, unless a different intention is discernible from the Amending Act. There is no such intention discernible from Amending Act 16 of 2018.

Justice v. Ramkumar is a Former Judge, at High Court of Kerala

Justice v. Ramkumar is a Former Judge, at High Court of Kerala