Ineligibility Criteria U/S 29A Of IBC: A Net Too Wide !

Richa Saraf & Sikha Bansal

18 Feb 2018 1:48 PM IST

Resolution plan is designated to be the "way-out" for insolvent entities coming under the Insolvency and Bankruptcy Code, 2016. The resolution professional appointed by the adjudicating authority constitutes a committee of creditors, invites resolution plans from prospective resolution applicants, and places the resolution plans before the committee of creditors. The resolution plan which is approved by the committee of creditors is submitted to the adjudicating authority for sanction. A resolution applicant, as defined under section 5(25) of the Code, earlier referred to mean any person who submits a resolution plan to the resolution professional. Hence, a resolution applicant might have been any person- a creditor, a promoter, a prospective investor, an employee, or any other person. The Code had not gone into the basis and criteria for selection of the resolution applicant. This became a fatal loophole in the law which allowed back-door entry to defaulting promoters at substantially discounted rates for the assets of the corporate debtor.

To curb the illicit ways, several amendments were made in the Code, first by way of Insolvency and Bankruptcy Code (Amendment) Ordinance, 2017[1] dated 23rd November, 2017, then by Insolvency and Bankruptcy Code (Amendment) Act, 2018[2] dated 19th January, 2018 ("Amendment Act"). Of all the amendments, the one which has become a riddle for all is section 29A. The section specifies persons not eligible to be resolution applicant, and has ten parts (i.e. clauses), the tenth part is further divided into three sub-parts, of which the third part has its own descendants. These layers of section 29A are more in the nature of elimination rounds. The write-up below digs deeper into the section.

Resolution Applicant – Who and Who Not?

Vide the Amendment Act, the definition of "resolution applicant" was amended so as to mean a person, who individually or jointly, submits a resolution plan to the resolution professional pursuant to the invitation made under section 25(2)(h).

Section 25(2)(h) requires the resolution professional to invite resolution plans from prospective resolution applicants who fulfill criteria as laid down by the resolution professional with the approval of committee of creditors, having regard to the complexity and scale of operations of the business of the corporate debtor and such other conditions as may be specified by the Board.

Section 29A is a restrictive provision- any person falling in the negative list is not eligible to submit a resolution plan.

Therefore, a person in order to be eligible to submit a resolution plan –

- shall fulfill the criteria laid down by the resolution professional with the approval of the committee of creditors; and

- shall not suffer from any disqualification mentioned under section 29A.

Section 29A – A Pandora Box

According to Section 29A, a person suffering from the disqualifications as mentioned hereunder shall not be eligible to submit a resolution plan. Further, any other person acting jointly or in concert with the prospective resolution applicant shall not be covered under the following disqualifications –

- the person is an undischarged insolvent;

- the person is a wilful defaulter in terms of the RBI Guidelines issued under the Banking Regulation Act, 1949;

- the person has an account, or an account of a corporate debtor under the management or control of such person or of whom such person is a promoter, classified as non-performing asset in accordance with RBI Guidelines issued under the Banking Regulation Act, 1949 and at least a period of 1 (One) year has lapsed from the date of such classification till the date of commencement of the corporate insolvency resolution process of the corporate debtor: Provided that the person shall be eligible to submit a resolution plan if such person makes payment of all overdue amounts with interest thereon and charges relating to non-performing asset accounts before submission of resolution plan;

- the person has been convicted for any offence punishable with imprisonment for 2 (Two) years or more;

- the person is disqualified to act as a director under the Companies Act, 2013;

- the person is prohibited by SEBI from trading in securities or accessing the securities markets; the person has been a promoter or in the management or control of a corporate debtor in which a preferential transaction, undervalued transaction, extortionate credit transaction or fraudulent transaction has taken place and an order has been made by the adjudicating authority under the provisions of the Code;

- a person who has executed an enforceable guarantee in favour of a creditor, in respect of a corporate debtor against which an application for insolvency resolution made by such creditor has been admitted under the Code;

- (ix) a person who has been subject to the above listed disabilities under any law in a jurisdiction outside India;

- (x) connected persons, i.e. persons connected to the person disqualified under any of the aforementioned points, such as those who are promoters or in management of control of the resolution applicant, or will be promoters or in management of control of the business of the corporate debtor during the implementation of the resolution plan, the holding company, subsidiary company, associate company or related party of the above referred persons – exception has been carved out for scheduled banks, asset reconstruction companies registered with RBI under Section 3 of the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002, and alternative investment funds registered with SEBI.

Major aspects of the provision have been analysed as below-

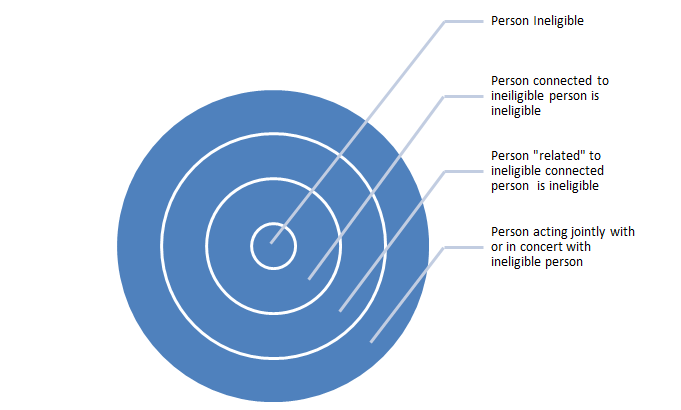

Layers of Ineligibility

An assiduous analysis of Section 29A reveals that the section imposes four layers of ineligibility, as mentioned below-

- First layer ineligibility, where the person itself is ineligible;

- Second layer ineligibility, i.e. where a "connected person" is ineligible;

- Third layer ineligibility, i.e. being a "related party" of connected persons; and

- Fourth layer ineligibility, where a person acting jointly/in concert with a person suffering from first layer/second layer/third layer ineligibility, becomes ineligible.

Clause (c): The NPA Criterion

Clause (c) of Section 29A debars a person or a person acting jointly or in concert with such person who-

- has an account classified as NPA;

- is a promoter of a corporate debtor the account of which has been classified as NPA;

- is in the management of a corporate debtor the account of which has been classified as NPA;

- is in control of a corporate debtor the account of which has been classified as NPA.

At least a period of 1 (One) year should have elapsed from the date of classification till the insolvency commencement date. Therefore, any company (including the promoters/persons in the management of or control of such company) which has its account classified as NPA for last 1 (One) year will not be able to file a resolution plan however, the Code provides for a carve out that such person shall be eligible to submit the resolution plan if such person makes payment of all overdue amounts with interest thereon and charges relating to non-performing asset accounts before submission of resolution plan. See also, clause (j) of Section 29A.

Clause (g): Vulnerable Transactions

According to clause (g) of Section 29A, a promoter/person in the management of or control of a corporate debtor in which a preferential transaction (Section 43), undervalued transaction (Section 45), extortionate credit transaction (Section 50), or fraudulent transaction (Section 49) have taken place and the adjudicating authority has passed an order under the Code. The provision is qualified to the extent it uses the term "corporate debtor", and that the adjudicating authority should have passed an order under the Code itself.

Clause (h): Guarantor executing guarantee in favour of the applicant creditor

The negative list includes persons who might have guaranteed the obligations of the corporate debtor which is currently in insolvency. As the provision goes, a person who has executed enforceable guarantee in favour of a creditor in respect of a corporate debtor against which an application for insolvency resolution made by such creditor has been admitted under the Code. Going by the construction of the clause, it appears that the guarantee should be in favour of that creditor who has applied for insolvency resolution of the corporate debtor.

The provision came up for discussion in RBL Bank Ltd. v. MBL Infrastructures Ltd. [CA(IB) No. 543/KB/2017; order dated 18.12.2017], where NCLT took a view that there was no intent of the Government to debar all the promoters, only for the reason for issuing a guarantee which is enforceable, unless such guarantee has been invoked and not paid for, or the guarantor suffers from any other antecedent listed in section 29A. The resolution applicants stated that by purporting to disqualify the entire class of guarantors under the said clause would be violative of the valuable rights of the applicant. If the guarantee is not invoked and demand is not made on the guarantor, the debt payable by him is not crystallized and the guarantor cannot be therefore said to be in default for breach of the guarantee and be penalized merely because a legal and binding contract of guarantee exists, which is otherwise impossible but is subject to its invocation in accordance with the terms of the guarantee. The NCLT agreed to the view observing that the guarantors in respect of whom, a creditor has not invoked the guarantee or made a demand under guarantee should not be prohibited. Therefore, no default in the payment of dues by the guarantor has occurred, cannot be covered under clause (h) of Section 29(A). It cannot be the intent of clause (h) to penalize those guarantors who have not been offered an opportunity to pay by calling upon them to pay the dues, by invoking the guarantee. Therefore, the words "enforceable guarantee" appearing in clause (h) are not to be understood by their ordinary meaning or in the context of enforceability of the guarantee as a legal and binding contract, but in the context of the objectives of the Code and Ordinance in general and clause (h) in particular.

Clause (j): Connected persons

The word "connected persons" appear in clause (j) of section 29A. A person who is connected to the persons as defined under the Explanation, shall be disqualified if the other person suffers disability under clause (a) to (i) of section 29A.

"Connected persons" have been defined so as to include three categories –

Explanation.— For the purposes of this clause, the expression "connected person" means-

(i) any person who is the promoter or in the management or control of the resolution applicant; or

(ii) any person who shall be the promoter or in management or control of the business of the corporate debtor during the implementation of the resolution plan; or

(iii) the holding company, subsidiary company, associate company or related party of a person referred to in clauses (i) and (ii):

The definition can be analysed as follows-

- Clause (i) includes:

- promoter;

- person in the management; and

- person in control

of an ineligible resolution applicant.

Further, in accordance with clause (iii),

- where (a) or (b) or (c) is a company, the holding, the subsidiary, and the associate companies or "related party" of (a), (b), (c) (as the case may be), shall also be disqualified.

- where (a) or (b) or (c) is a natural person, any "related party" of such person shall also be disqualified.

- Clause (ii) basically seeks to debar persons from submitting resolution plans in which persons suffering from disabilities mentioned under Section 29A are proposed as promoters or in the management of or in the control of the corporate debtor during implementation of the resolution plan. It includes-

- would-be promoter;

- person, would-be in the management; and

- person, would-be in control

of the corporate debtor, who suffer from disqualification under section 29A.

For example, A wants to submit resolution plan for B Ltd. A proposes that C shall be in the management of B Ltd. during the implementation of the resolution plan. However, C is a person suffering disability under Section 29A. A, therefore becomes ineligible to submit resolution plan.

Further, in accordance with clause (iii),

- where (a) or (b) or (c) is a company, the holding, the subsidiary, and the associate companies or "related party" of (a), (b), (c) (as the case may be), shall also be disqualified.

- where (a) or (b) or (c) is a natural person, any "related party" of such person shall also be disqualified.

For scope of the term "related party", see below.

Note that from the scope of "holding company, subsidiary company, and associate company", the following have been excluded, i.e. the following can proceed to submit the resolution plan-

- a scheduled bank; or

- an ARC registered with RBI under section 3 of the SARFAESI Act, 2002; or

- an AIF registered with SEBI.

Related party

"Related party" has been defined in Section 5 (24); however, the definition is specific to corporate debtor, i.e. the definition specifies the persons who shall be treated as "related party' of the corporate debtor. Hence, where the persons referred to in clauses (i) and (ii) of the Explanation are persons other than the corporate debtor, the definition under section 5(24) becomes irrelevant, and the following may be noted-

- Where one of the person is a company, "related party" shall be interpreted in terms of section 2(76) of the Companies Act, 2013;

- Where none of the persons is a company, the definition of the term "related party" has been left open. In the context of natural persons, generally the term "relative" is used.

Associate Company

For the purpose of determining whether a company is an associate of the other, the definition as under Section 2(6) of the Companies Act, 2013 shall be referred, wherein "Associate company", in relation to another company, means a company in which that other company has a significant influence, but which is not a subsidiary company of the company having such influence and includes a joint venture company.

For the purpose of the said definition, "significant influence" means control of at least 20% (twenty per cent) of total share capital, or of business decisions under an agreement.

For example- "Company X" holds 20% of total share capital of Company "Y", then Company X will be deemed to be an associate company of Company Y.

Relevant time- whether lookback allowed?

A relevant question would be regarding the point of time at which the ineligibility has to be ascertained. The language of the section suggests that only present status of the resolution applicant has to be seen. No lookback period has been prescribed. However, the authors opine that it would be upon the committee of creditors to decide on whether any past event shall be weighed upon while making the final decision.

More of a Diktat?

The Code has been designed to find the best possible way out for an ailing entity- it was meant to be more inclusive in approach. However, the reach of Section 29A extends to four layers (as explained above), and may lead to exactly opposite results. The intent of the Code was not to restrict genuine applicants, but only to exclude participation from habitual miscreants or applicants who might themselves be sick, however, Section 29A may result in elimination of persons who might be interested in buying stakes in the entity.

See RBL Bank Ltd. v. MBL Infrastructures Ltd. [CA(IB) No. 543/KB/2017; order dated 18.12.2017], where the NCLT, considering the objective of the Ordinance, 2017, opined that clause (h) of section 29A is not to disqualify the promoters as a class for submitting a resolution plan. The intent is to exclude such class of persons from offering a resolution plan, who on account of their antecedents, may adversely impact the credibility of the processes under the Code. The case is, for the time being, pending with NCLAT[3].

The Code was designed to find the best possible way out for an ailing entity- it was meant to be more inclusive in approach and there was definitely no intention to avoid promoters from submitting resolution plans. However, the reach of Section 29A extends to four layers (as explained above), and may lead to exactly opposite results. It is quintessential to ensure that the citadel of insolvency resolution does not have holes into it but at the same time, it is also important to ensure that the citadel is not inaccessible, with no steps, doors or windows.

The intent of Section 29A will be counter- productive if it results into a whole lot of intending resolution applicants being disentitled, because the recursive definitions of related party, connected persons etc are cast wide enough, intertwining all the entities promoted by an entity.

[1] http://ibbi.gov.in/webadmin/pdf/legalframwork/2017/Nov/180404_2017-11-24%2007:16:09.pdf

[2] http://ibbi.gov.in/webadmin/pdf/legalframwork/2018/Jan/182066_2018-01-20%2023:35:29.pdf

[3] Last update as on 10.02.2018.[The opinions expressed in this article are the personal opinions of the author. The facts and opinions appearing in the article do not reflect the views of LiveLaw and LiveLaw does not assume any responsibility or liability for the same]