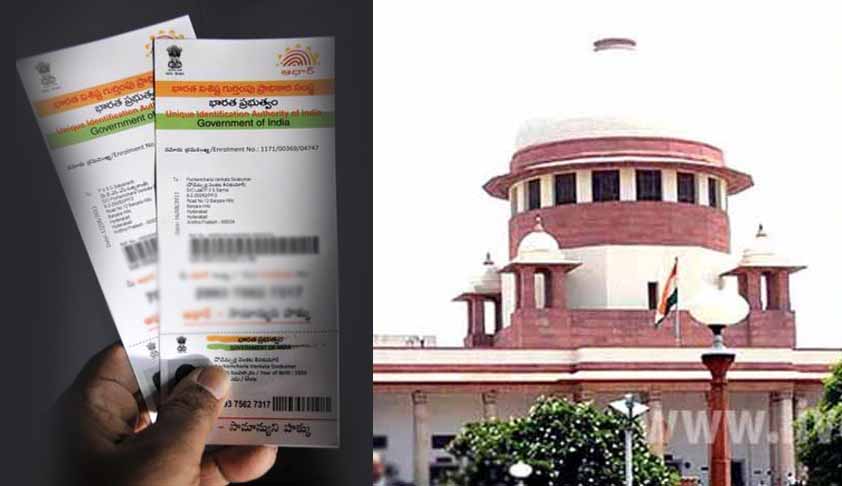

Ex-Kerala Minister Moves SC Against Linking Of Aadhaar With PAN

LIVELAW NEWS NETWORK

9 April 2017 11:41 AM IST

Next Story

9 April 2017 11:41 AM IST

Former Kerala minister and CPI leader Binoy Viswam has filed a writ petition in the Supreme Court challenging the constitutional validity of S. 139AA of the Income Tax Act, 1961, alleging it to be ‘illegal and arbitrary’ and ‘violative of Articles 14 and 21 of the Constitution.’The petitioner submitted that he is a tax-paying citizen and does not hold an Aadhaar card till date nor has...