- Home

- /

- High Courts

- /

- Jharkhand High Court

- /

- Refusal By JBVNL To Reimburse...

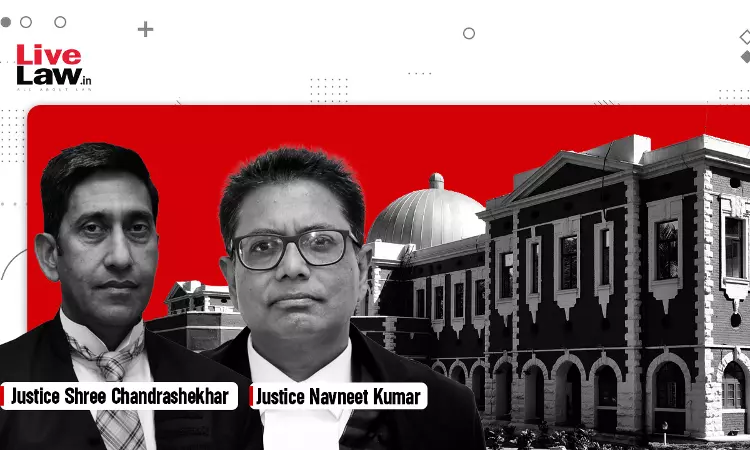

Refusal By JBVNL To Reimburse Contractor GST Impact On Indirect Transactions Violative Of Article 14: Jharkhand High Court

Mariya Paliwala

6 May 2024 11:00 AM GMT

The Jharkhand High Court has held that the action of Jharkhand Bijli Vitran Nigam (JBVNL) offends Article 14 of the Constitution of India by refusing to reimburse contractor GST impact on indirect transactions.“This is a settled law that the state and its instrumentalities are required to demonstrate fair play in action. In “ABL International Ltd. and Another,"17 the Hon'ble Supreme...

The Jharkhand High Court has held that the action of Jharkhand Bijli Vitran Nigam (JBVNL) offends Article 14 of the Constitution of India by refusing to reimburse contractor GST impact on indirect transactions.

“This is a settled law that the state and its instrumentalities are required to demonstrate fair play in action. In “ABL International Ltd. and Another,"17 the Hon'ble Supreme Court observed that even in contractual matters, the state and its instrumentalities are required to follow the equality clause under Article 14 of the Constitution of India. The petitioner-firms were agitating for their right to refund or reimbursement for a long ,” the bench of Acting Chief Justice Shree Chandrashekhar and Justice Navneet Kumar observed.

For the rural electrification under the Dindayal Upadhyay Gram Jyoti Yojna (DDUGJY), the bids were invited by the JBVNL on different dates, and the petitioner-firms were selected for the implementation of the scheme.

As per clause 10.7 and clause 31 of the General Conditions of Contract (GCC), any increase in the price of the indirect transactions on account of a change in the tax regime was to be borne by the contractor, which was inclusive of the taxes. The direct transactions are confined to the purchase of materials by the JBVNL directly from the petitioner-firms, wherein the price quoted is exclusive of taxes. The other transactions labeled as indirect transactions included the bought-out items and the materials procured by the petitioner-firms from the other vendors and sold to the JBVNL.

As the transactions involved in the implementation of the rural electrification works fell under the definition of “supply” as defined under Section 7(1) of the GST Act, concerns about the differentiation made between the direct and indirect transactions were raised from time to time.

The REC issued a circular on June 30, 2016, which clarified that the impact of the GST on the contract shall be considered in totality. On the same lines, the REC issued another circular on June 19, 2018, making further clarification as to the impact of the GST on indirect and bought-out transactions. It is common ground that a pre-bid clarification meeting was held and clause 10.7 of the GCC was amended, and that was incorporated in the LOAs through clause 28.

The stand taken by the State of Jharkhand was that notwithstanding the amendment in clause 10.7, the provision under clause 31 of the GCC shall apply, and the contractor cannot claim reimbursement of the GST impact on the procurement of raw materials, intermediary components, etc., and the bought-out items.

The petitioner-Firms contended that the action of the respondent-JBVNL offends the equality clause under Article 14 of the Constitution of India inasmuch as a refusal to reimburse the contractor the GST impact on indirect transactions shall breach the rule of promissory estoppel and be against the doctrine of legitimate expectation. The JBVNL, which continued to pay the GST impact on the affected transactions in total and adhered to the amended clause 10.7 of the GCC until August 2019, could not have stopped the reimbursement and started recovering the payments so made to the contractors on the specious ground that it was a provisional arrangement for the GST reimbursement. There is no ambiguity or conflict between the contract documents, and the effect of the amendment in clause 10.7 of the GCC cannot be taken away on the ground that clause 31 reflects a different intention.

The petitioner-firms argued that, as per Section 64-A of the Sale of Goods Act, 1930, the respondents are under an obligation to pay the taxes, duties, and levies in the event of any change in the law, and the contractor has a right to add such an additional amount of tax to the contract price and recover the GST impact from the respondents.

The department contended that the question of law involved in this batch of writ petitions is whether the petitioner-firms are entitled to the reimbursement of the GST paid by them on the indirect transactions, even though clause 31 specifically bars such claims by the contractor, and this larger question has been left open by the Supreme Court to be decided in an appropriate case. The argument in the alternative is that the Court may make a reference to the larger bench for deciding the question of law as indicated in the order passed by the Supreme Court.

The court noted that now, only because the NITs were floated on different dates or the LOAs or the agreements were executed pre-GST regime, the benefit of GST reimbursement on indirect transactions under the amended clause 10.7 of the GST cannot be denied to such petitioner- firms. The stand taken by the JBVNL is that the pre-bid clarification that resulted in the amendment to clause 10.7 and subsequent incorporation of clause 28 in the GCC shall not be available to the petitioner-Firms, which violates the basic norms of justice, equity, and fair play.

The court held that the petitioner- firms and other similarly situated contractors are entitled to reimbursement of the GST impact on the indirect transactions on which the GST was imposed.

Counsel For Petitioner: Ajit Kumar Sinha

Counsel For Respondent: Rajiv Ranjan

Case Title: Sri Gopikrishna Infrastructure Pvt. Ltd. & Ors. Versus The State of Jharkhand

LL Citation: 2024 LiveLaw (Jha) 72

Case No.: W.P. (T) No. 6712 of 2023